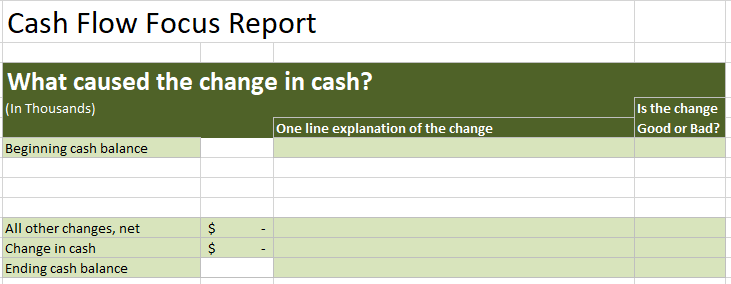

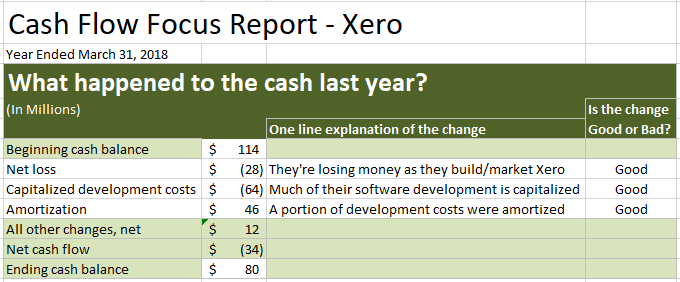

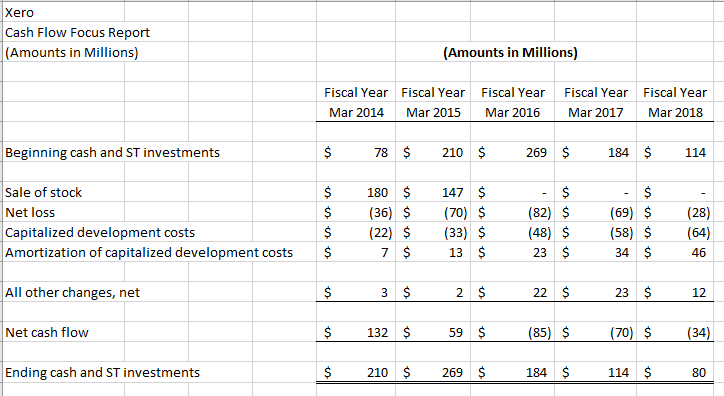

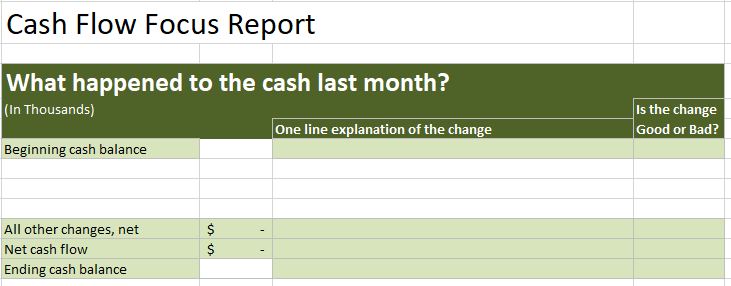

In Part 4 of this blog post series on making cash flow simple and easy to understand, I introduced you to the Cash Flow Focus Report. It is a simple, common sense tool for understanding your cash flow that takes 10 minutes a month. It brings focus to your cash flow, simplifies your life, and leads to an understanding and sense of confidence that you will find freeing.

In Part 3 of this blog post series, I talked about a VERY different approach to defining cash flow. It is an approach where I like to take my CPA and CFO hat off and speak in a common-sense language that everyone can relate to.

In Part 2 of this blog post series, I showed you that “cash flow” is not a single number on your financial statements. And I talked about why now is the time to totally rethink (and greatly simplify) how you go about understanding and managing cash flow in your business.

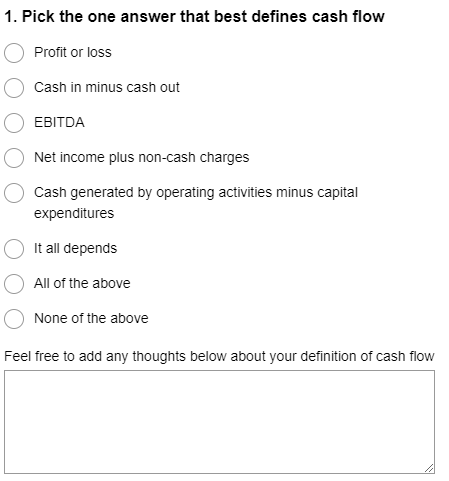

In Part 1 of this blog post series, I shared the surprising results of my super-short survey that asked “How do YOU define cash flow in your business”?

Here’s Why Cash Flow Has Always Been So Confusing

In this post, I want to take a couple minutes to talk about why cash flow has always been so confusing and complicated for business owners.

Understanding each of these factors will help you see why the Cash Flow Focus Report is so different from anything you have ever seen. The focus report is designed to overcome each of the four reasons cash flow has always been so messy and confusing for business owners.

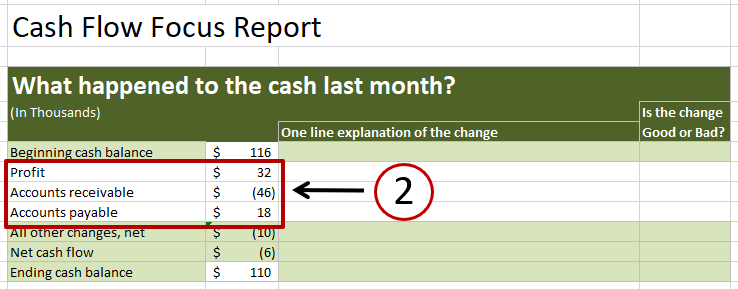

Reason #1 – Profit (or Loss) Does Not Equal Cash Flow

I routinely hear business owners say, “I know my business is profitable… but for some reason cash is always tight.” Or they say “I showed a nice profit last month… but I have less cash in the bank as a result. How can that be?”

It creates confusion in their mind and makes them feel like they have some sort of “cash flow leak” somewhere in their business. But they are unsure where the leak might be. Or why it was happening. Or how to fix it.

It also creates a question in their mind about whether the financial statements they get from their bookkeeper or accountant are accurate. Or reliable. With no good answers or solutions to their concerns, the tendency is to “punt” on understanding what is going on with the cash, and just hope that the cash flow will eventually take care of itself.

It seems logical to assume that if you “made money” last month then you must have more money, more cash, as a result. But showing a profit in your P&L does not mean you created any cash. By the same token, showing a loss in your financial statements does not necessarily mean you lost any cash. Profit or loss does not equal cash flow in any given month.

You can prove it to yourself real fast. Grab your P&L for last month and compare your profit number to the change in cash for the month. They will never be the same. The accounting rules that govern the creation of a P&L are about measuring profit or loss – not cash flow.

Over time, profit is a very important driver of cash. That is absolutely true. But it does not change the fact that profit does not equal cash flow. Even a P&L prepared on the cash basis of accounting does not change the fact that the amount of profit or loss in your financial statements does not equal cash flow. This is an important fact to get your arms around.

Reason #2 – There is No Clear Definition of Cash Flow

Most people understand profit or loss because it is a single number you can see on your P&L. But cash flow is not that simple.

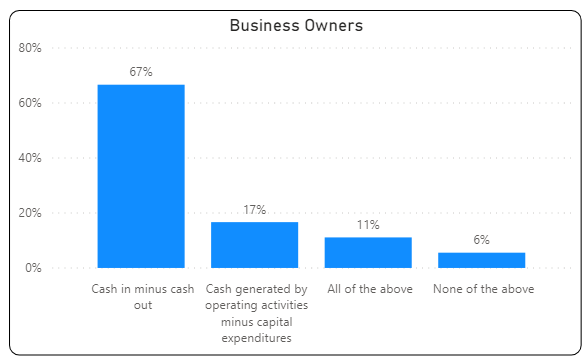

In a recent blog post, I asked “how do YOU define cash flow in your business?” Here is the list of potential answers I provided in the survey:

You can see the survey responses here.

When you go to your favorite search engine and look for an official definition of cash flow, you get a variety of answers. Here are four different sites and their definition of cash flow:

Merriam-Webster’s online dictionary: “A measure of an organization’s liquidity that usually consists of net income after taxes plus noncash charges against income.”

Dictionary.com: “The sum of the after-tax profit of a business plus depreciation and other noncash charges: used as an indication of internal funds available for stock dividends, purchase of buildings and equipment, etc.

Wikipedia: Cash flow is “payments into or out of a business, project, or financial product.”

Investopedia.com: “Cash flow is the net amount of cash and cash-equivalents being transferred into and out of a business. At the most fundamental level, a company’s ability to create value for shareholders is determined by its ability to generate positive cash flows.”

The Merriam-Webster and Dictionary.com definitions are along the lines of putting a single number, a single dollar amount, on cash flow.

The Wikipedia and Investopedia.com definitions are more along the lines of describing cash flow in terms of money moving into and out of a business. Although you can put a number on those two definitions if you assume that “Payments into and out of a business” and “Cash flow is the net amount of cash and cash-equivalents being transferred into and out of a business” to mean that cash flow is the increase or decrease in the cash balance for the period. The net of the money coming in minus the money going out (net cash flow).

Here is a quick example of how these various definitions produce different results for “cash flow” when looking at a company’s financial statements.

I have a set of financial statements for a small business in front of me right now. When I use the Merriam-Webster definition of cash flow, I come up with an answer that says cash flow for the month was $55,863. It is calculated as “net income after taxes plus noncash charges against income”. The number does not appear by itself in the financial statements, but I can calculate it from the P&L, balance sheet, and statement of cash flows.

Using the same company financial statements, when I use the more “flow” related definitions of cash flow from Wikipedia and Investopedia.com, I get an answer that says cash flow for the month was ($87,120) – meaning the cash balance went down (it was negative) for the month by $87,120. Using this definition, I calculated cash flow as the change in the cash balance for the month. I can get this number from the statement of cash flows. I can also calculate the number by subtracting the end of month cash balance from the beginning of the month cash balance on the balance sheet.

Here’s the rub. In one definition, cash flow was a positive $55,863. In the other definition, cash flow was a negative $87,120. That’s pretty much the definition of confusion.

Most business owners are surprised to learn that the two words “cash flow”, by themselves, do not show up on their financial statements. You will NOT see a line item labeled “cash flow” on your P&L, balance sheet, or even on your statement of cash flows.

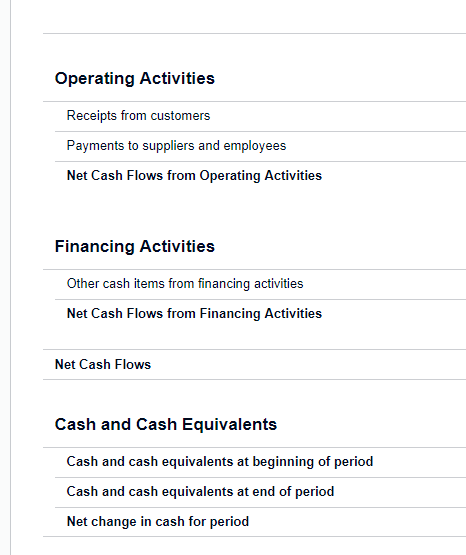

When you run the Statement of Cash Flows in QuickBooks, the words “cash flow” appear only once in the report (as “cash flows”)… and that’s in the title of the report. The title of the report is “Statement of Cash Flows”. That is the only place on the report where the words “cash flow” appear.

There is no line item in QuickBooks with a description or dollar amount associated with the two words “cash flow” in the Statement of Cash Flows. Or your P&L. Or your balance sheet.

In the Statement of Cash Flows, you will see line items like “Net cash provided by operating activities”, “Net cash provided by investing activities”, “Net cash provided by financing activities”, “Net cash increase (decrease) for the period”, etc. Each one of those line items has a dollar amount associated with it. But none of those line items are labeled “cash flow”… and the two words “cash flow” don’t even appear in those descriptions.

No wonder the definition of cash flow confuses so many business owners (as well bookkeepers and accountants).

If you run the Statement of Cash Flows report in the online accounting software Xero, the words “cash flow” appear more often. You can read more about what Xero shows here.

Reason #3 – The Statement of Cash Flows is Difficult to Understand

Here is the reality of the beautifully named, but woefully misunderstood, statement of cash flows:

- Business owners rarely see it, never use it, and don’t understand it.

- Bookkeepers never prepare it and don’t understand it.

- Accountants and CPAs rarely prepare it (except when required to), seldom use it, and don’t know how to make it useful for business owners.

Financial statements are prepared using the rules of accounting. The rules of accounting are about measuring profit or loss and financial position. The rules of accounting are not designed to measure the flow of money through a business. In fact, most accounting transactions recorded by bookkeepers and accountants have no impact on cash. Consider an example where you invoice a customer for a product or service they bought from you.

Recording an invoice that you just sent to a customer creates revenue and profit in your P&L. And it creates an accounts receivable on your balance sheet. AND, here is the really weird part, it also shows up on your statements of cash flows… even though your cash balance is unaffected. Creating that invoice had absolutely zero impact on cash… but it still shows up in all three of your financial statements.

The rules of accounting are such that an accounting transaction that has nothing to do with money coming in or money going out, still creates “cash flow” in your statement of cash flows. That’s because the rules of accounting are focused on measuring revenues, expenses and financial position. The rules are about recording the flow of accounting transactions not the flow of cash through your business. We accountants like complexity and confusion. 😊

There are two more reasons the statement of cash flows is difficult to understand. The first reason is that the statement of cash flows is a reconciliation. It reconciles net income (your profit or loss) from your P&L to the change in your cash balance for the period being presented. It is an accounting exercise that takes a bit of a “shortcut” approach to identifying how changes in the P&L and balance sheet ultimately reconcile to the change in the cash balance.

It’s a report created by accountants… for accountants… and for those who have a deep understanding of the rules of accounting and a deep understanding of how the three financial statements fit together. The interesting thing is that most bookkeepers don’t understand how to prepare it (and therefore don’t provide one). And many accountants are not comfortable creating it either. The reconciliation component of the statement of cash flows creates some brain damage even for those who understand the rules of accounting.

The second reason the statement of cash flows is difficult to understand is that it presents too much information on the report. It’s not unusual to run a statement of cash flows in QuickBooks and it show multiple pages of positive and negative numbers flying around that ultimately reconciles net income to the change in your cash balance for the month.

As an example, I just pulled up a statement of cash flows in QuickBooks for a small business with 15 employees. The statement of cash flows has 41 lines on it.

People mistakenly believe that more information equals greater clarity. From jury instructions to instruction manuals, we’re witnessing an epidemic of overexplaining. This seems to be based on the fallacy that if you provide people with more information, it will yield greater understanding. In fact, the opposite is true: Too much information overwhelms people. It creates fuzziness, not clarity. When inundated with information, people are apt to lose sight of what’s important and stop paying attention.”

Simple: Conquering the Crisis of Complexity, by Alan Siegel and Irene Etzkorn

More is not better when it comes to understanding and managing your cash flow. The Cash Flow Focus Report is going to help us solve this problem.

Reason #4 – An Increase in Cash is Not Always Good… and a Decrease in Cash is Not Always Bad

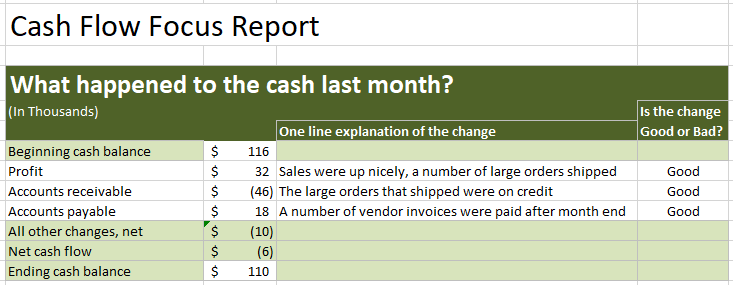

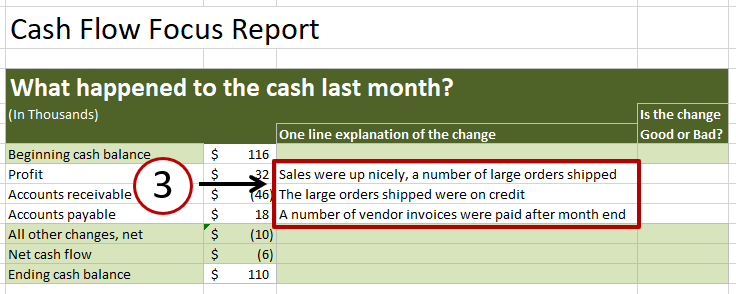

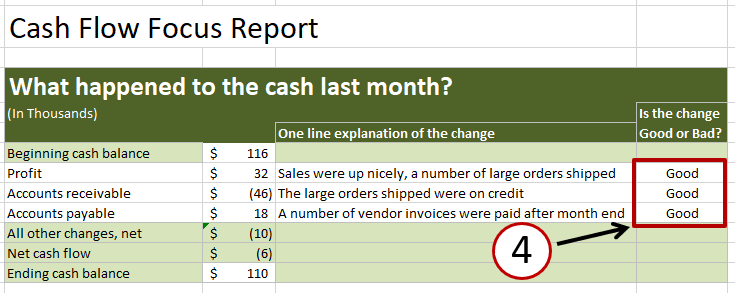

In Part 2 of this blog post series, I shared an example from a small business where their cash balance went down last month, but they were delighted with their cash flow. Here is the result of their review of cash flow for the month.

The 2-Minute Conversation: “Cash was down $50k for the month to $150k. The primary drivers of cash were a strong profit that came in better than our expectations, good collections on our accounts receivable from customers, and we paid off the final $100k of our debt.”

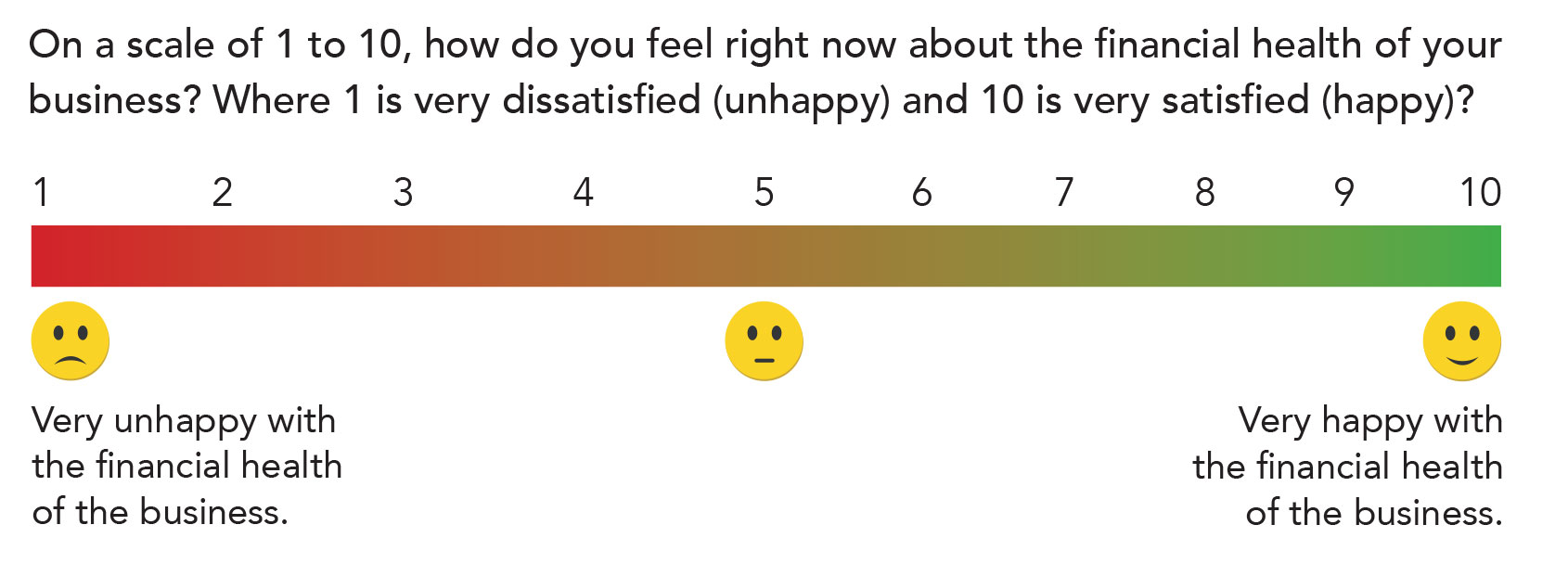

Our Happiness Rating for the Month: 10

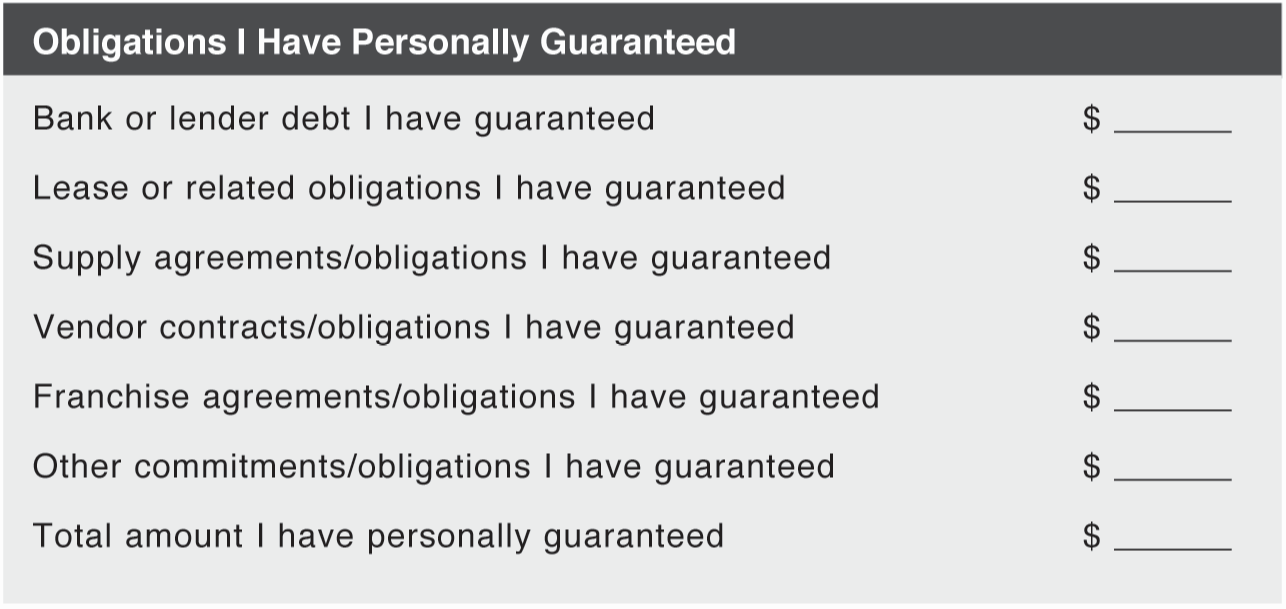

The payment of their last $100k of debt is what made their cash balance go down for the month. They had been focused on becoming debt-free in their business for three years. Over that three-year period they had paid off almost $500,000 of debt. Now they have zero debt. They felt absolutely on top of the world.

In another business, the cash balance was down for the month because their bank had threatened to pull their line of credit unless they paid the debt down ASAP. Being forced to pay their debt down so abruptly put them in bind financially. That was a bad thing.

Your cash balance can be down for the month for lots of good reasons like making a big investment to grow your business and serve more customers, making distributions of excess cash to the owners of the business, and paying down debt.

And your cash balance can be up for the month for lots of bad reasons like borrowing money to fund losses (digging a financial hole), the owner being forced to put more money into the business, not making payments on existing debt, and paying vendors late.

When you look at the increase or decrease in your cash balance for the month, the critical question is: “What caused the change”? When you can answer that question simply and quickly, you will know whether the change in cash is good or bad.

Also, it is important to recognize that the cash balance on your balance sheet is the balance at a specific point in time. If you were looking at your June balance sheet, the cash shown there is the balance at the end of the day on June 30. The balance would be different the day before and the day after.

For example, in one business the owner’s cash balance was down $6,000 in May. The primary reason for that reduction was that one of his larger customers had not paid a $20,000 invoice on time. The good news is the $20,000 arrived on June 1. The cash balance at May 31 did not look so good… but everything was fine with respect to cash flow because the cash came in the very next day.

Keep in mind when deciding whether an increase or decrease in cash is good or bad that your cash balance is being measured on a specific date.

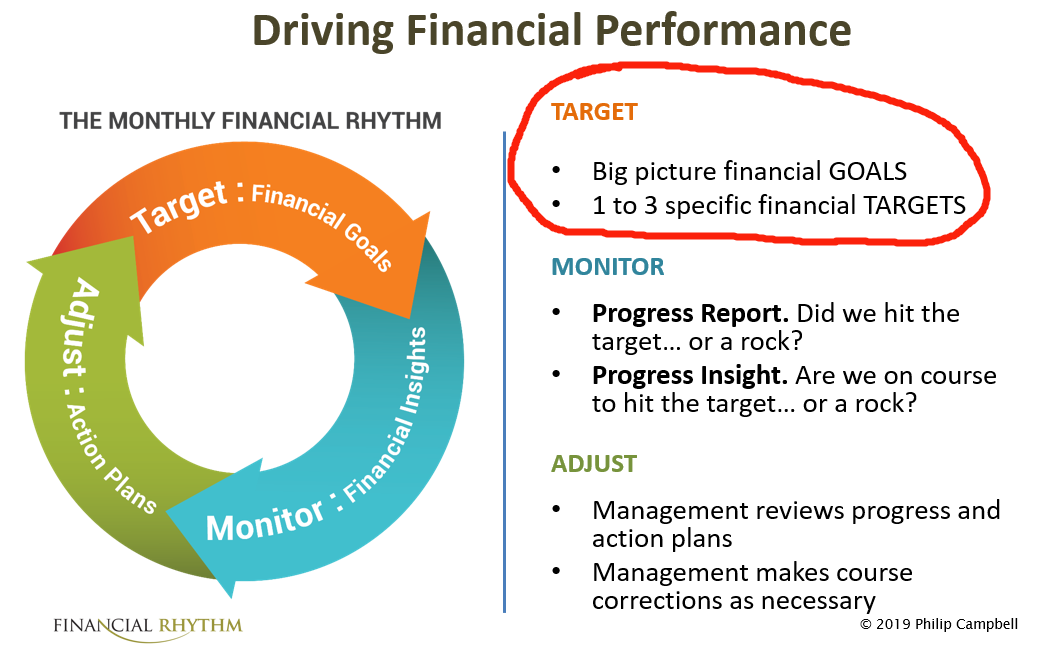

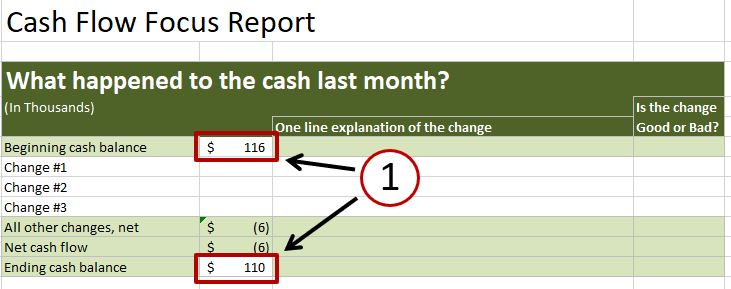

Putting the Cash Flow Focus Report to Work

In my next post in this series, I will walk you through the step-by-step process for creating the Cash Flow Focus Report.

For me, it’s the secret to making cash flow simple and easy to understand each month.

Philip Campbell is an experienced financial consultant and author of the book A Quick Start Guide to Financial Forecasting: Discover the Secret to Driving Growth, Profitability, and Cash Flow and the book Never Run Out of Cash: The 10 Cash Flow Rules You Can’t Afford to Ignore. He is also the author of a number of online courses including Understanding Your Cash Flow – In Less Than 10 Minutes. His books, articles, blog and online courses provide an easy-to-understand, step-by-step guide for entrepreneurs and business owners who want to create financial health, wealth, and freedom in business.

Philip’s 35 year career includes the acquisition or sale of 35 companies (and counting) and an IPO on the New York Stock Exchange.

Understanding Your Cash Flow – In Less Than 10 Minutes

This online course teaches you the step-by-step process for simplifying your cash flow. I walk you through each lesson while you watch, listen, read and try it yourself using your own cash flow numbers.

The course is very affordable. And there are also some coaching options available if you would like to get up and running fast.

It’s a fantastic way to learn the process.

I take all the risk out of your purchase because I include a 100%, no questions asked, money-back guarantee. You love it or you get your money back in full. Period.

There are two things that are very unique and exciting about this online course.

1. I’ll show you how to understand your cash flow in less than 10 minutes

2. I’ll show you how to explain what happened to your cash last month to your business partner or banker (or maybe even your spouse) in a 2-minute conversation.

I take off my CPA hat and I speak in the language every business owner can relate to. No jargon. No stuffy financial rambling. Just a simple, common sense approach that only takes 10 minutes a month.

Here is how one business owner describes the benefits of the course.

“I googled cash flow projections and found your website online and it appealed to me mainly due to the fact that you speak in laymen’s terms in a way that a non-financially trained person can understand.

The fact that you said you can understand your cash flow in less than 10 minutes a month was also a big reason I bought it. And the fact that you acknowledge that most accountants and CPA’s speak in terms that the normal owner cannot understand and that you would be able to put things in understandable terms really got me.

The monthly cash flow focus report was the best feature for me because learning to do it helped me understand my cash flow statements and the biggest drivers of cash flow.

Another significant benefit is the definitions of cash flow drivers and descriptions of how a negative or positive sway in cash within those drivers affects cash flow. Being able to see at a quick glance monthly what happened to your cash using the focus report is a huge benefit.”