Financial forecasting is the ideal tool for helping you make better business decisions. It provides you with the view through the financial windshield of your business.

Imagine driving your car on the freeway without a clear view through the windshield. The question isn’t whether you will crash. The question is how severe will the crash be… and will you survive.

Making better business decisions is step one to creating better financial results. And the faster you make those business decisions, especially when your results have been going in the wrong direction, the faster you can make the changes that lead to improvements in profitability and cash flow.

In the Preface to the book Future Ready: How to Master Business Forecasting, the authors (Steve Player & Steve Morlidge) say:

… the biggest value in effective forecasting lies in its contribution to steering the business; to the day-to-day decision-making that lies at the very heart of business. Decision-making is driven by information – without it management is no more than guesswork – and it comes in two ways. There is information about the past (actuals) and then there is information about the future (forecasts).”

What’s missing in many organizations today is information about the future (especially the near future).

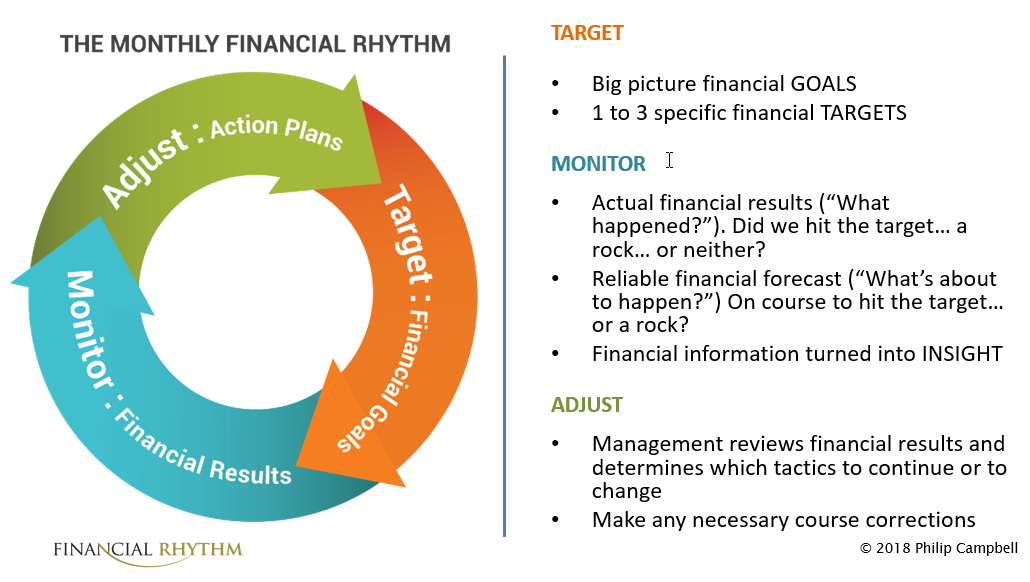

A reliable financial forecast fills that gap by providing the forward-looking view of financial performance. It fits beautifully in the planning and performance management process because it can shave a good three to six months off the normal decision-making timeframe.

There is a significant lag in most organizations between when the leadership team sees financial results they don’t like and when they actually make changes in the business to get results back on track.

What happens is the management team is executing their strategy and waiting for the financial statements to come out so they can see the financial results. When the results are not good they scratch their heads, and wonder what the problem is.

Oftentimes they conclude that something is just weird in the numbers that month and say, “These numbers don’t make sense. Let’s see what the numbers look like next month.” Another month goes by and the actual results come out and the results tell a similar story. Management still doesn’t quite believe the numbers so they are not ready to make changes in the strategy or tactics in the field.

Finally, a couple more months go by and they are forced to admit that changes are needed in the strategy in order to have an impact on results. Three to six months can go by and thousands or millions of dollars go down the drain as a result.

Financial Forecasting Helps You Make Better Business Decisions… Faster

A reliable financial forecast can short circuit that process because the view of what is about to happen provides feedback on results before they even happen. Then when the actuals come in, and they turn out to be like the forecast, the team has confirmation that the view through the windshield is providing them with reliable information that a course correction is required.

It’s a powerful way to help you and your leadership team make better, faster business decisions.

And better business decisions lead to better financial results.

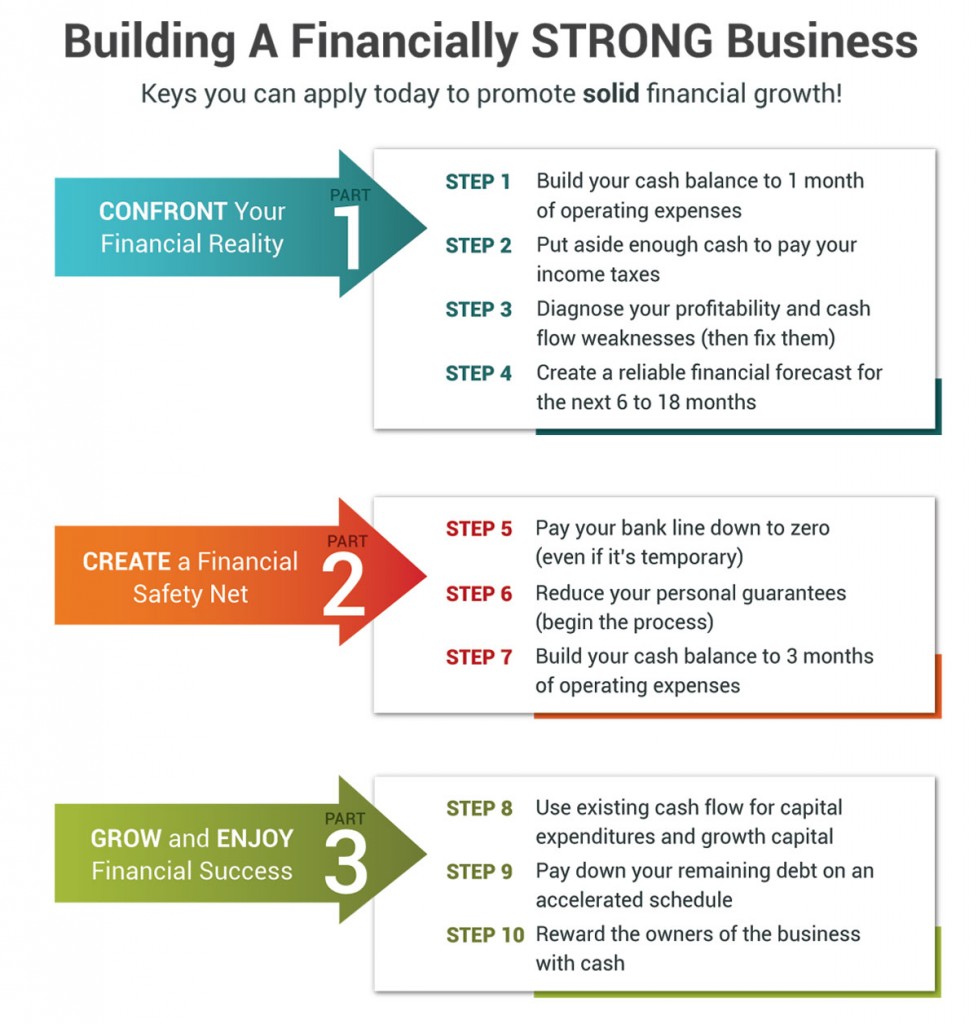

Philip Campbell is a CPA, financial consultant, and author of the book A Quick Start Guide to Financial Forecasting: Discover the Secret to Driving Growth, Profitability, and Cash Flow and the book Never Run Out of Cash: The 10 Cash Flow Rules You Can’t Afford to Ignore. He is also the author of a number of online courses including Understanding Your Cash Flow – In Less Than 10 Minutes. His books, articles, blog and online courses provide an easy-to-understand, step-by-step guide for entrepreneurs and business owners who want to create financial health, wealth, and freedom in business.

Philip’s 30 year career includes the acquisition or sale of 33 companies (and counting) and an IPO on the New York Stock Exchange.

This book provides a straightforward, easy-to-understand guide to one of the most powerful financial tools in business: a reliable financial forecast. It will transform the financial future of your company and help you make better, faster, smarter financial decisions.

Too many entrepreneurs and CEOs today are feeling more like passengers than drivers in their business. They’re staring at their rearview mirror as they bounce along in the passenger seat. Their company is careening along on the highway of business as they wonder and worry about where their business might end up financially.

A reliable financial forecast solves this problem by providing a clear view through the financial windshield of your business. It creates the visibility and clarity you need to drive your company toward a bigger and brighter financial future.

What if you had answers to questions like:

What’s about to happen to my profitability and cash flow?

How much cash can we distribute to the owners of the business?

How long will it take to pay off our debt?

What will our taxable income be this year?

A reliable financial forecast puts the answers to these questions at your fingertips. It helps you take control of your profitability and cash flow because it gives you answers to the most important financial questions you have to deal with every day.

Put yourself in the driver’s seat of your business by tapping into the unique and exciting benefits that financial forecasting can unlock for you.

Buy the Kindle version at Amazon.

Buy the book at Barnes & Noble.

If you already own the book, the free tools and downloads are waiting for you. Click here to access the financial spreadsheets, examples, rapid learning guides, and more.