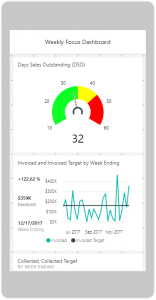

I developed the Cash Flow Focus Report to provide a simple, common sense approach to understanding your cash flow that only takes 10 minutes a month. It brings focus to your cash flow, simplifies your life, and leads to an understanding and sense of confidence that you will find freeing.

The very first thing I do when looking at a company for the first time is create the Cash Flow Focus Report. If I work in the business or I’m a shareholder, I create the focus report every single month. I also create the focus report if I am looking at making an investment in a company (public or private).

It’s a super-simple way I use to understand the drivers of cash flow and keep my finger on the pulse of the company’s cash flow.

At the heart of the focus report is to answer this ONE question:

“What happened to the cash?”

One of the beauties of asking a simple question like that is it deserves a simple answer (and very little work to arrive at the answer). As Albert Einstein said:

“If you can’t explain it simply, you don’t understand it well enough.”

In my view of the world, that ONE question is the single most important question to help me understand what makes a company tick financially. Cash is the real bottom line in business. And this ONE question helps me quickly understand “what’s going on with the cash.”

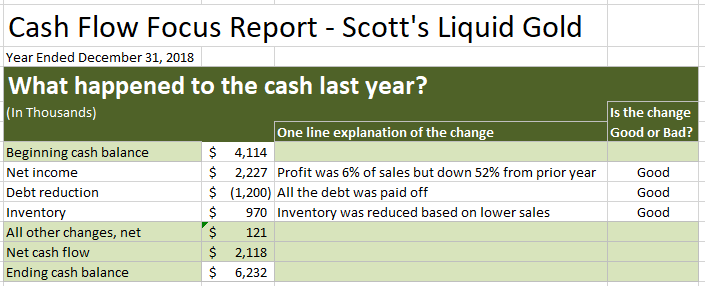

An Example – Scott’s Liquid Gold, Inc.

I came across a public company recently, Scott’s Liquid Gold, Inc and decided learn more about the company and determine whether I wanted to invest in the company and become a shareholder. Step 1 was to look at their most recent financial results and answer THE question:

“What happened to the cash last year?”

I pulled up a blank Cash Flow Focus Report and got started on answering that question for 2018. Here is what the completed focus report looked like.

There are 4 steps to creating the Cash Flow Focus Report.

- Drop in the beginning cash balance and the ending cash balance

- Identify the three largest changes in cash

- Write a one-line explanation of the change

- Determine whether each change in cash is good or bad

I grabbed the Company’s Statement of Cash Flows for 2018 and got started.

Here is a short discussion of the three largest changes, or drivers, of cash for 2018 together with the one-line description of each change and my rationale for labeling each change as good.

Net Income

The company made $2.2 million in 2018 (after income taxes). That’s about 6% of sales. Not too shabby. Problem is their net income last year was $4.7 million. That means net income this year is down about 52%. The press release that accompanied the 2018 financial results included a comment from the CEO Mark Goldstein, that said “We experienced sales challenges in December after a strong start to the quarter and several of our mass retail and specialty channel customers began to aggressively reduce inventory levels earlier than their historical patterns.” In deciding to label this change as either good or bad, I would normally look at the forecast or the budget for profitability to see if the $2.2 million is line with expectations and strategy. In this case, absent having access to forecast or budget numbers, I labeled it as good because net income of 6% of sales is not too shabby. (The big question is which direction net income is headed for the coming year.)

Debt Reduction

The second largest change, or driver, of cash in 2018 was a $1.2 million reduction of debt. They paid off all their debt this year (some of it early). They have zero debt now on their balance sheet at the end of 2018. I almost labeled this change as fantastic rather than just good. 😊 I’m a big believer that reducing debt is critical to managing a business well.

Inventory

The third largest change in cash was a $970k reduction in inventory. Reducing inventory frees up cash so the change is added back to cash for 2018. My assumption is they reduced inventory, at least in part, in response to lower sales during the fourth quarter. They also mention in the press release that they are “focused on reducing inventory levels.” They have almost 137 days of inventory on hand, so I applaud their focus on reducing inventory. I labeled this change in cash as good since the reduction is in line with lower sales and it appears on the surface that they need to reduce inventory.

The 2-Minute Conversation

Once I create a Cash Flow Focus Report, my next step is to articulate the “2-minute conversation.” Assume you are about to sit down with your banker, or your business partner, or an investor (maybe even your spouse).

You have 2-minutes to briefly explain to them “what happened to the cash.” Not the nitty-gritty-greasy-grimy details. Just a short, big picture discussion about the company’s cash flow that enlightens the people you are talking to.

The goal of the 2-minute conversation is to provide them that understanding… while also demonstrating to them that you know what’s going on in your business. (Imagine their horror if they discovered that you, the person running the business, didn’t know what’s going on with the cash flow!)

Here is my version of the 2-minute conversation for Scott’s Liquid Gold’s 2018 financial results:

“Cash increased during the year by $2.1 million. Net income was down significantly from the prior year but still came in at $2.2 million (6% of sales). Inventory was reduced by almost a million dollars, partly in response to lower sales and profit for the year. $1.2 million was used to pay off all the debt, leaving a cash balance at the end of the year of $6.2 million.”

Summary View of Cash Flow Over the Last Five Years

I also like to look at a summary view of cash flow over the last five years or so to learn about the financial history of the company. This is a great way to see a financial overview from a big picture, “what’s going on with the cash”, perspective.

Here are some observations about their cash flow over the last five years:

- In 2015, the big jump in net income is primarily driven by the reversal of a reserve on their deferred taxes. The offset, since this was a non-cash adjustment, is in the deferred tax line. The deferred taxes relate to accumulated losses in prior years that they expect to use to offset income taxes in future years (which you can see in years 2016 through 2018).

- In 2016, the company purchased certain assets from Ultimark, including the Prell, Denorex and Zincon brands of hair and scalp care products. The purchase price was $9.0 million (paid in cash). The purchase included $400k inventory, $7.1 million of intangibles, and goodwill of $1.5 million. They borrowed about $2.4 million to help fund a portion of the acquisition.

- In 2018, net income was down about 52% from the prior year. The reduction was partly driven by lower sales in the fourth quarter. They paid off the remaining debt from the 2016 acquisition and the cash balance ended the year at $6.2 million.

The History of the Company

In 2016 Scott’s Liquid Gold celebrated its 65th anniversary. Very impressive.

Here is a summary from their blog:

“Owning a family business in America is a bit of a paradox. Family businesses make up more than 80 percent of all American businesses. Only 30% percent of family businesses, however, survive into the 2nd generation. And less than 12% survive into the 3rd generation according to the Family Business Institute. Scott’s Liquid Gold is one of the 12% that is still going strong well into the third generation!

Ida Goldstein, a widow with three sons bought the formula for Scott’s Liquid Gold for $350 in 1951. Her oldest son, Jerry, took the lead with the family business. For the next 49 years, he went on to build a trusted brand and thriving business. Jerry’s son, Mark, began working with his father after graduating from Syracuse University in 1978. Jerry and Mark worked together for the next 22 years until Jerry’s death in 2000. Today, Mark continues at the helm as President and CEO.”

Scott’s Liquid Gold, Inc. develops, manufactures, markets and sells household and skin and hair care products. The Company operates through two segments: household products and skin and hair care products.

The Company’s products include Scott’s Liquid Gold, its wood cleaner and preservative; Alpha Hydrox, its skin care brand; Neoteric Diabetic product, which is specially developed to address the skin conditions of persons living with diabetes; Montagne Jeunesse face masque sachets, which are manufactured by another company and distributed by it in the United States, and Batiste Dry Shampoo, which is manufactured by another company and distributed by the Company to the specialty retailer channel in the United States.

The products in the household products segment include Scott’s Liquid Gold Wood Cleaner and Preservative; Scott’s Liquid Gold Floor Restore; Scott’s Liquid Gold Wood Wash; Scott’s Liquid Gold Dust ‘N Go Wipes, and Touch of Scent Air Freshener.

Big Picture Facts

Here are some interesting facts about the company:

- 27% of sales are to Walmart. 24% of sales are to Ulta.

- Their primary brands are Scott’s Liquid Gold, Alpha Skin Care, Prell, and Denorex. They also act as the exclusive distributor of products in certain markets. These products include 7th Heaven by Montagne Jeunesse and Batiste Dry Shampoo.

- The skin and hair care products portion of the business represents 86% of sales. Household products represents 14% of sales.

- The Scott’s Liquid Gold product has been declining. They have been working hard to bring new products to market to help offset that portion of the business.

- They have 74 employees and are based in Denver, CO.

- They are a public company with about 650 shareholders.

- Mark Goldstein, the CEO and a member of the Founding family, owns (directly or indirectly) about 25% of the outstanding common stock.

What is The Big Picture View of Your Business?

I encourage you to walk through this same kind of big picture financial and cash flow review for your business. Business owners are always amazed at what they learn in this exercise. The numbers, the cash, almost always tells a different story than what the owner or CEO thinks has happened over the years.

Remember, the real bottom line in business is cash! Knowing what’s going on with the cash is a requirement in business. The penalties for not paying attention to the cash can be huge… and incredibly painful.

Here is a link to my post that provides the step-by-step guide to simplifying your cash flow with the Cash Flow Focus Report.

Philip Campbell is a financial consultant, and author of the book A Quick Start Guide to Financial Forecasting: Discover the Secret to Driving Growth, Profitability, and Cash Flow and the book Never Run Out of Cash: The 10 Cash Flow Rules You Can’t Afford to Ignore. He is also the author of a number of online courses including Understanding Your Cash Flow – In Less Than 10 Minutes. His books, articles, blog and online courses provide an easy-to-understand, step-by-step guide for entrepreneurs and business owners who want to create financial health, wealth, and freedom in business.

Philip’s 30 year career includes the acquisition or sale of 33 companies (and counting) and an IPO on the New York Stock Exchange.

Understanding Your Cash Flow – In Less Than 10 Minutes

This online course goes deeper into the Cash Flow Focus Report and teaches you the step-by-step process for simplifying your cash flow. I walk you through each lesson while you watch, listen, read and try it yourself using your own cash flow numbers.

The course is very affordable. And there are also some coaching options available if you would like to get up and running fast.

It’s a fantastic way to learn the process.

I take all the risk out of your purchase because I include a 100%, no questions asked, money-back guarantee. You love it or you get your money back in full. Period.

There are two things that are very unique and exciting about this online course.

1. I’ll show you how to understand your cash flow in less than 10 minutes

2. I’ll show you how to explain what happened to your cash last month to your business partner or banker (or maybe even your spouse) in a 2-minute conversation.

I take off my CPA hat and I speak in the language every business owner can relate to. No jargon. No stuffy financial rambling. Just a simple, common sense approach that only takes 10 minutes a month.

Here is how one business owner describes the benefits of the course.

“I googled cash flow projections and found your website online and it appealed to me mainly due to the fact that you speak in laymen’s terms in a way that a non-financially trained person can understand.

The fact that you said you can understand your cash flow in less than 10 minutes a month was also a big reason I bought it. And the fact that you acknowledge that most accountants and CPA’s speak in terms that the normal owner cannot understand and that you would be able to put things in understandable terms really got me.

The monthly cash flow focus report was the best feature for me because learning to do it helped me understand my cash flow statements and the biggest drivers of cash flow.

Another significant benefit is the definitions of cash flow drivers and descriptions of how a negative or positive sway in cash within those drivers affects cash flow. Being able to see at a quick glance monthly what happened to your cash using the focus report is a huge benefit.”