I use a reliable financial forecast as a tool for improving the financial health and well-being of the business I am working with. There are other uses of a financial forecast like trying to raise capital or borrow money, evaluating an acquisition opportunity, updating a business plan, or similar uses. But the real power is having a forecast tool in place that helps you monitor and improve the financial health of your business month-to-month and year-to-year.

In this post, I will show you how to get a reliable financial forecast up and running quickly.

My favorite way to start the forecasting process with a business owner, or even a company where I am a shareholder, is to put a number on the extent to which the business owner is happy or unhappy with the financial health of their business. The question looks like this:

The reason I like to start with this rating is that it helps me focus on what we are trying to achieve with the forecasting process. And it serves as a constant reminder that the forecast is all about helping achieve financial improvement goals. Not by sticking goals and targets in the forecast. But by using the forecast as an unbiased, reality-based tool for helping the company along on its journey to financial health and well-being. It is also important to note that I work primarily with small to medium size businesses. I am asking this question of a person whose net worth is riding on the success of the company. So, a question like this that is targeted to how the owner “feels right now” is relevant. And it adds a sense of fun to the process at the same time.

Here is how I define a reliable financial forecast:

- Reliable – Unbiased, reality-based expectation of financial results that is designed for decision-making (not precision).

- Financial Forecast – A full set of forward-looking financial statements that includes a 2-minute summary. It’s a big picture view. And it’s an important part of the Monthly Financial Rhythm of financial management.

It is unbiased because the forecast is not a target. It is not an aspiration for what we want or hope the financial results to be. It is a reality-based expectation of what is likely to happen given where the company is trending today. The forecast is used for making key decisions about how to steer the company toward it’s ultimate destination. It is not about precision. In fact, precision (and detail) is the enemy in creating a reliable financial forecast.

The forecast is a full set of financial statements – an income statement, balance sheet, and statement of cash flows by month. The 2-minute summary is the outcome of the forecast. It is how you communicate to the owners or the leadership team the results of the forecast in a summarized and insightful format. I’ll show you an example of that in just a minute. The forecast is big picture in that you are not rolling up a bunch of lower level assumptions or accounts. It is driven at the level of summarized financial statements. And its an important component of what I refer to as the Monthly Financial Rhythm of business. I’ll talk more about that in just a minute.

How the Forecast Tool Fits in the Improvement Process

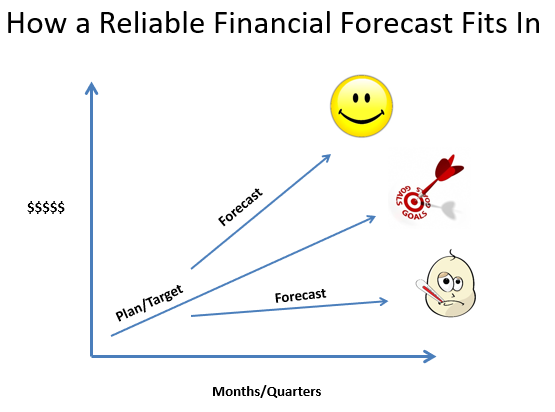

This image provides a really nice view of the role that a reliable financial forecast plays in the overarching objective of improving the financial health of your business. Actual results show what happened last month or last year. Forecast results show what’s about to happen next month or next year. The mission of the owners or leadership team is to use both actual and forecast results to evaluate whether they are on track to achieve their goals. The goals are not imbedded in the forecast any more than they are embedded in the actuals. The actuals are the actuals. And the forecast is the expectation based on current trends. The actuals and forecast work together as tools to help management make good decisions and improve the financial health and well-being of the company from month-to-month and year-to-year.

The Monthly Financial Rhythm

The monthly financial rhythm is another way of showing you how I use the forecasting process as a tool for driving financial results. When I am a shareholder in a company, or when I am providing a service for an owner or CEO, this is the monthly rhythm I use to manage and monitor financial performance. I refer to it as the target, monitor, adjust cycle. The targets are the 1 to 3 key financial targets. Monitor is about turning actual and forecast results into insight for management. Adjust is the process where management determines what’s working and not working and makes any necessary changes or adjustments to achieve the goals and targets.

The actual financial results answer the question “What happened?” Did we hit the target, a rock, or neither? The forecast answers the question “What’s about to happen?” Are we on course to hit the target… or a rock?

The monthly financial rhythm is a monthly process. Generally, every three to six months or so the targets are changed. Earlier goals and targets are achieved or changed. New goals and targets are identified as you continue the ongoing process of monitoring and improving the health of the business.

This image provides another view of how the forecast is not the target or the goal. The forecast provides an unbiased expectation of what’s about to happen financially. When the forecast indicates a problem is brewing, then management evaluates that information and considers any necessary course corrections to get back on track. When the forecast shows really good things are expected, management uses that information in the same way. They may want to “put the peddle to the metal” to try to drive performance even higher. Or they may claim victory and begin working on other parts of the business that need improvement. In both cases the forecast is being used for decision making.

Let’s look now at five rules for creating a forecast you can trust.

It is built top-down, NOT bottom-up. This is where many people get tripped up when creating their forecast. Creating historical financial statements is a bottom-up process of gathering and recording thousands of transactions and reporting the results in the form of accurate financial statements. But creating a financial forecast is a top-down exercise. Forecasting a set of financial statements uses big-picture drivers and assumptions to create a model of what the financial statements might look like based on existing trends and plans. You take yourself up to the 30,000-foot level and look down on the business financially as you forecast. It’s about painting a picture of what the financial results will likely be based on your knowledge and intuition rather than a rolling up of actual transactions or detailed general ledger accounts.

First look back, then look forward. One of the biggest mistakes entrepreneurs (and CFOs) make in creating a forecast is to start with a clean slate. They pull up a blank spreadsheet and begin thinking about what the first month in the forecast will look like. The problem is you unhook your forecast from reality when you do that. The first step should be to drop in actual results for the last six to eighteen months (or more). Begin looking at the key drivers and metrics to see how they move from month-to-month in the historical results. Look at those drivers and metrics with an eye to which ones appear to be the best to use to drive your forecast assumptions.

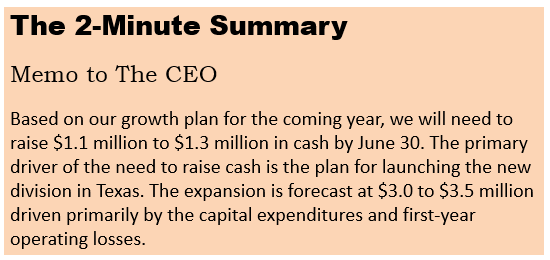

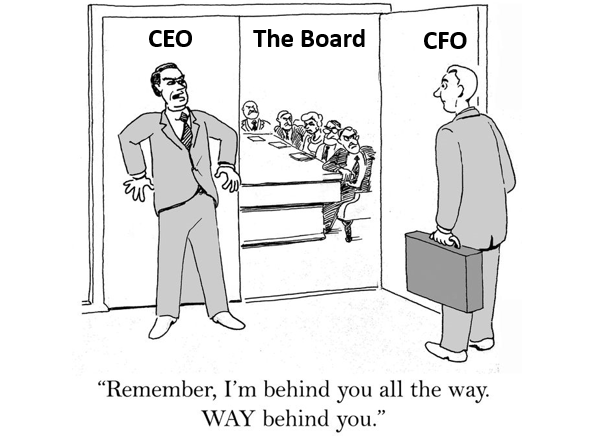

Present the results in a 2-minute summary. Creating a reliable forecast, and effectively communicating it to your audience, starts with making the forecast results simple and easy to understand. Here is a helpful exercise that works especially well when implementing a forecast process for the first time. Imagine you will sit down with the CEO or board tomorrow morning. In that meeting, you will have two minutes to convey the essence of the forecast (key insights, implications, and assumptions) to him or her. That person will then step into another meeting with the company’s key shareholders and lenders to share his or her insight about where the company is going financially. Your mission: Ensure they can share the insights from the forecast with confidence and clarity. This exercise will force you to distill the insights and implications of the forecast down to what matters most so that you can clearly identify and communicate the most important high-level drivers and assumptions.

Start for your eyes only. As you make progress in creating your forecast, it’s natural to want to begin sharing it immediately. However, keep it “for your eyes only”— at least to start. That means don’t sell your leadership team on the value of having a forecast, don’t talk to them about the assumptions or specifics as you create the forecast, and don’t send the results of the forecast to them—yet. Instead, spend a few months “beta testing” your forecast to learn from and experiment with the process before rolling it out to the management team or the board. Create assumptions at the highest level possible to prove to yourself that you don’t need to forecast at the detail level. Create the forecast for the next three months, then compare the actual results each month. What worked out well? Are you surprised at the difference between your forecast and the actual results?

Simplify, simplify, simplify. One of my favorite quotes, known as Meyer’s Law, says: “It’s a simple matter to make things complex, but a complex matter to make things simple.” You will be surprised how difficult this advice is to implement once you begin creating, and regularly updating, your financial forecast. The number of potential rabbit holes you can dive into while forecasting is huge. With all the assumptions you have to make in creating your forecast, it is very important to think about one of the more counterintuitive facts about forecasting: The more detail you bring into the forecasting process, the more error you will create. The key to success in forecasting is to always be thinking about how to simplify, simplify, simplify…and simplify some more. Simplify the key drivers, critical assumptions, and how you interpret and present the results of the forecast.

The Magic Question in Forecasting

When you are thinking about how to forecast an income statement, balance sheet, and cash flow, and do it in a simplified top-down approach, the magic question to ask yourself is:

“What two numbers can I multiply together to arrive at the forecast number?”

Forecasting revenue is a good example. Let’s consider a company that owns and operates 100 restaurants. There are lots of different detailed drivers of revenue at each of its locations. Number of customers, average ticket, size of restaurant, same store sales, new vs. mature locations, rural locations vs. big city locations, local demographics at each location, number of tables, which locations provide a take-out option, which provide delivery options, lunch vs dinner traffic, etc.

But the magic question isn’t what twenty numbers or drivers can use to arrive at our forecast for revenues. The question is which two can we use. In our multi-unit restaurant example, one of the best approaches I have found is to use store count multiplied by average revenue per store. I did this with a public company I bought some stock in and it turned out to be an exceptionally reliable way for me to forecast quarterly revenue. Even though I only had access to their publicly available information.

For other retailers, it might be number of customers multiplied by the average ticket. Or last year sales multiplied by the same store sales trend. For a law firm, it might be hours incurred multiplied by average billing rate. For a fuel wholesaler, it might be gallons multiplied by average selling price.

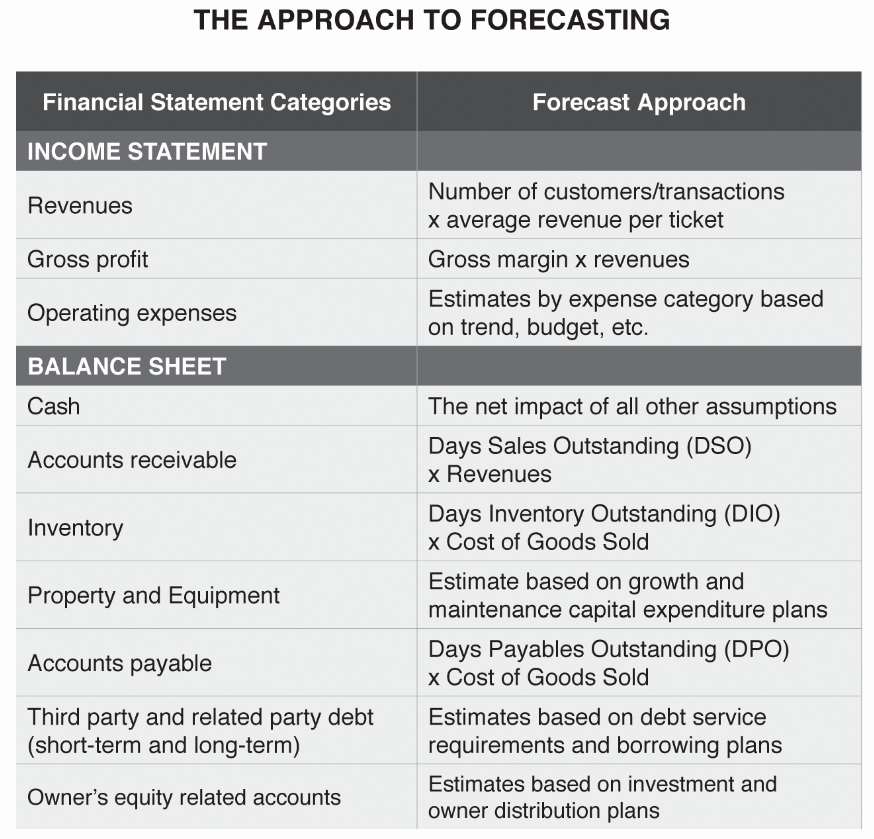

The image below is an exhibit in my book A Quick Start Guide to Financial Forecasting: Discover the Secret to Driving Growth, Profitability, and Cash Flow Higher. It shows you the approach assumptions across both the income statement and balance sheet lines.

Here’s a question for you: “How many people will you have to rely on to provide you with accurate estimates as you create and maintain your forecast?” Remember, this is a top-down process. We are not going to be asking the sales team to estimate their sales by month and send it to us so we can accumulate their responses and drop the number in the forecast for revenues. So, the answer to the question is it will take ONE person. A quick look in the mirror will show you who that one person is. 😊 Of course, you can have someone else create and maintain the forecast for you… but it should only be one person doing it.

I mentioned earlier that the primary output of your forecast is the 2-minute summary. It is a simple and effective way to share the insights from the forecast… and do it with confidence and clarity. It will force you to distill the insights and implications of the forecast down to what matters most so that you can clearly identify and communicate the most important high-level drivers and assumptions. I seldom provide the actual forecast income statement, balance sheet, and statement of cash flows as the product of the forecast. There are so many numbers on a forecast set of financial statements that it is more likely to create confusion than clarity.

The Quick Start Essentials

Now let’s look at the steps you can take to get your forecast process up and running quickly.

The 3-2-1 principle is the perfect place to start. It says:

- List 3 questions the forecast will answer. I’ll show some examples below.

- Two numbers is the limit for each assumption. We talked about the importance of driving your forecast using the question “What two numbers can I multiply together to arrive at the forecast number?”

- Only one person creates the forecast. A mirror identifies that person. 😊

Here are some examples of some questions a forecast might be used to answer:

- How much cash can we distribute to the owners this year?

- Will we need to borrow money to achieve our growth plans (and how much)?

- How much debt can we pay down this year?

- How much cash should I set aside to pay income taxes?

- What will the financial statements look like next month?

Disconnect the forecast from any other schedule or process. This may be the most important tip I can provide for you. Let me give you an example. I was talking to a CFO recently who was struggling to get a good forecast process up and running. The company was fairly new and sales were growing fast. Sales were going up 25% or more each quarter. And that growth was putting a big strain on cash. He had a process in place where he was projecting when each customer invoice was going to be paid by the customer. He was doing this because cash, and the need to borrow to super their growth, was super-important. He was trying to build a full financial forecast and that customer payment projection was one of several similar bottom-up processes he was trying to use to drive parts of his bigger picture forecast. His thought was that he had some of these projection processes and now he just needed to pull it together and begin rolling things up to the financial statement level. My advice for him was simple. Those schedules are fine for the limited purpose he was using them. But do not use them in your financial forecast. Put them aside and build a forecast that is top-down, not bottom-up. It may sound counterintuitive to a financial person, but it doesn’t work to build a forecast from the bottom up with that kind of detail.

Dramatically shorten the forecast period. I will usually begin the forecast period with about three months. There is a temptation to have the forecast period be 12 to 18 months out. But the longer forecast period will make things more complicated and difficult to get started. In fact, one approach I often use to shorten the forecast period to zero. I load 12 to 24 months of historical financial statements and begin my analysis of the key drivers and metrics. Then I treat the last three months of that period as my forecast. So, I begin testing different drivers and assumptions and review the results. I can then compare my “forecast” to the actuals to get a sense for what seems to be working well and what’s not working so well. This can be a great way to get started.

First get it wrong… then get it close. Brian Tracy is an author and speaker who has some great advice that I believe applies very well here. He said “Anything worth doing well is worth doing poorly at first.” As you are getting your forecast process up and running you want to gently remind yourself that you have permission to get it wrong… at first. Then improve the process until you get it close. Then improve it some more until you get to where you have a reliable financial forecast.

Remember, the principle we talked about a few minutes ago that when you are getting a forecast process up and running you want to make it for your eyes only. I suggest you don’t share your early drafts of your forecast. Instead, spend a few months “beta testing” your forecast to learn from and experiment with the process before rolling it out to the management team or the board.

My next tip is summed up beautifully in the comic above. When I look at that image, I see a Board of Directors that wants the CFO to bring them good financial news. The CEO knows that his CFO is about to deliver some unwanted to news… and he wants to be as far away from the shooting of the messenger as possible. It is also an example of how bias is usually built into a forecast. When a forecast is being presented to the Board, oftentimes it is because management wants to get their approval for a plan or an acquisition. So, the forecast is really a goal or target that has been designed as more of a sales pitch than an unbiased view of likely financial results. This is not a reliable financial forecast.

A Quick Start Guide to Financial Forecasting

Here are the key ideas and insights in the Introduction to my book A Quick Start Guide to Financial Forecasting (you can also download a PDF of the Introduction here):

The purpose and promise of the book

Working with serious-minded entrepreneurs and CEOs

The two financial questions you (and your CFO) must answer every month

Think decision making, not precision

Walking through the forecasting process

The introduction to A Quick Start Guide to Financial Forecasting is meant to quickly communicate the purpose and promise of the book.

I like for the reader to quickly know whether the book speaks to them – while at the same time providing a quick overview of the benefits you can expect from reading the book.

Philip Campbell is an experienced financial consultant and author of the book A Quick Start Guide to Financial Forecasting: Discover the Secret to Driving Growth, Profitability, and Cash Flow and the book Never Run Out of Cash: The 10 Cash Flow Rules You Can’t Afford to Ignore. He is also the author of a number of online courses including Understanding Your Cash Flow – In Less Than 10 Minutes. His books, articles, blog and online courses provide an easy-to-understand, step-by-step guide for entrepreneurs and business owners who want to create financial health, wealth, and freedom in business.

Philip’s 35 year career includes the acquisition or sale of 35 companies (and counting) and an IPO on the New York Stock Exchange.

A Quick Start Guide to Financial Forecasting

Discover the Secret to Driving Growth, Profitability, and Cash Flow Higher

This book provides a straightforward, easy-to-understand guide to one of the most powerful financial tools in business: a reliable financial forecast. It will transform the financial future of your company and help you make better, faster, smarter financial decisions.

Too many entrepreneurs and CEOs today are feeling more like passengers than drivers in their business. They’re staring at their rearview mirror as they bounce along in the passenger seat. Their company is careening along on the highway of business as they wonder and worry about where their business might end up financially.

A reliable financial forecast solves this problem by providing a clear view through the financial windshield of your business. It creates the visibility and clarity you need to drive your company toward a bigger and brighter financial future.

What if you had answers to questions like:

What’s about to happen to my profitability and cash flow?

How much cash can we distribute to the owners of the business?

How long will it take to pay off our debt?

What will our taxable income be this year?

A reliable financial forecast puts the answers to these questions at your fingertips. It helps you take control of your profitability and cash flow because it gives you answers to the most important financial questions you have to deal with every day.

Put yourself in the driver’s seat of your business by tapping into the unique and exciting benefits that financial forecasting can unlock for you.

Buy the Kindle version at Amazon.

Buy the book at Barnes & Noble.

If you already own the book, the free tools and downloads are waiting for you. Click here to access the financial spreadsheets, examples, rapid learning guides, and more.