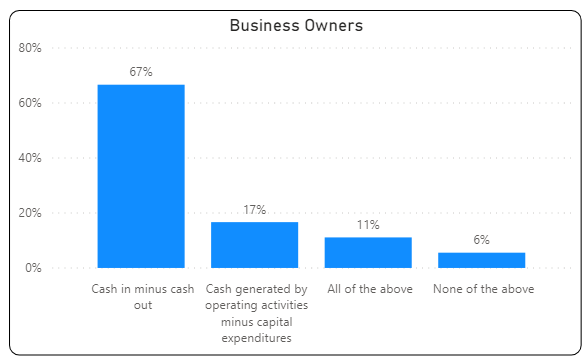

In Part 1 of this blog post series on making cash flow simple and easy to understand, I shared the surprising results of my super-short survey that asked “How do YOU define cash flow in your business”?

In this post, I’ll show you that “cash flow” is not a single number on your financial statements. And why it is time to totally rethink how to understand what’s going on with your cash flow.

First, let’s clarify what I mean by the word “cash”.

What is “Cash”?

When I use the word “cash” in the context of business, I am referring to “money”. Specifically, money in the bank. Which is a little different than how the word cash is used in our personal life.

Think about when you go to a grocery store or a convenience store to buy something. You are asked whether you will be paying by cash or credit/debit card. In this case, the store is referring to cash as dollar bills. If you use “cash” at a store, it means you are pulling money out of your wallet or your purse.

In a business context, I will be referring to cash as money in its electronic form… as numbers flying around in the digital world and ending up in your bank account. I will be referring to the line item on your balance sheet labeled “Cash”.

Cash is easy to measure. You can look at your balance sheet for any period and see a line item labeled “Cash”. It shows you how much cash you had at that point in time. It was $452,367. Or 225,959. Or $93,283. It is a single number on a separate line of your balance sheet. It’s the amount of money you have in the bank.

But things get a little more difficult when you add the word “flow” to the word “cash”. Now you have cash flow – or money flow. But that creates some interesting questions:

- How do you define money flow… or cash flow?

- Can you measure it for a specific month or year?

- How would you go about putting a single number on the flow of money through your business?

Cash Flow is NOT a Single Number on Your Financial Statements

Most business owners are surprised to learn that the two words “cash flow”, by themselves, do not show up on their financial statements. You will NOT see a line item labeled “cash flow” on your P&L, balance sheet, or even on your statement of cash flows.

When you run the Statement of Cash Flows in QuickBooks, the words “cash flow” appear only once in the report (as “cash flows”)… and that’s in the title of the report. The title of the report is “Statement of Cash Flows”. That is the only place on the report where the words “cash flow” appear.

There is no line item in QuickBooks with a description or dollar amount associated with the two words “cash flow” in the Statement of Cash Flows. Or your P&L. Or your balance sheet.

In the Statement of Cash Flows, you will see line items like “Net cash provided by operating activities”, “Net cash provided by investing activities”, “Net cash provided by financing activities”, “Net cash increase (decrease) for the period”, etc. Each one of those line items has a dollar amount associated with it. But none of those line items are labeled “cash flow”… and the two words “cash flow” don’t even appear in those descriptions.

No wonder the definition of cash flow confuses so many business owners (as well bookkeepers and accountants).

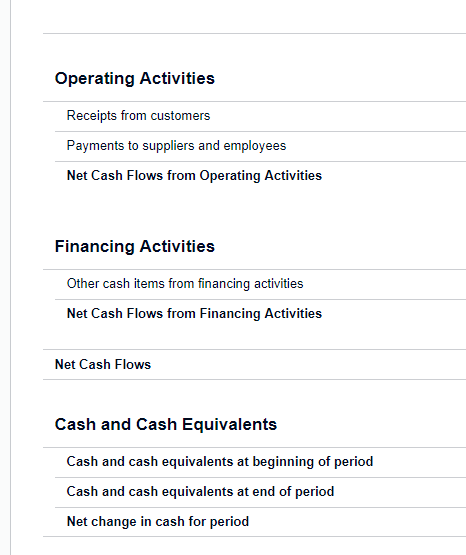

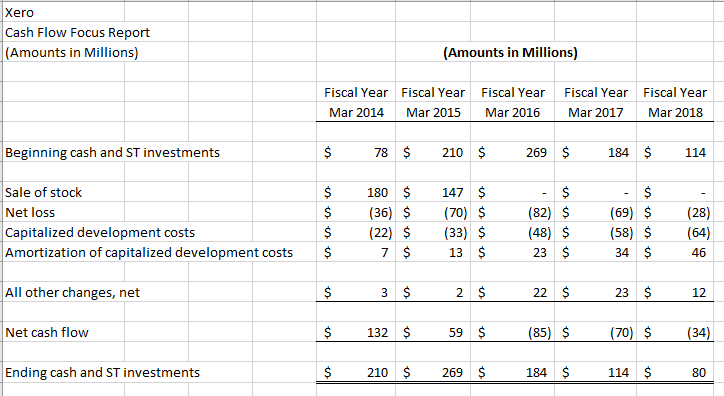

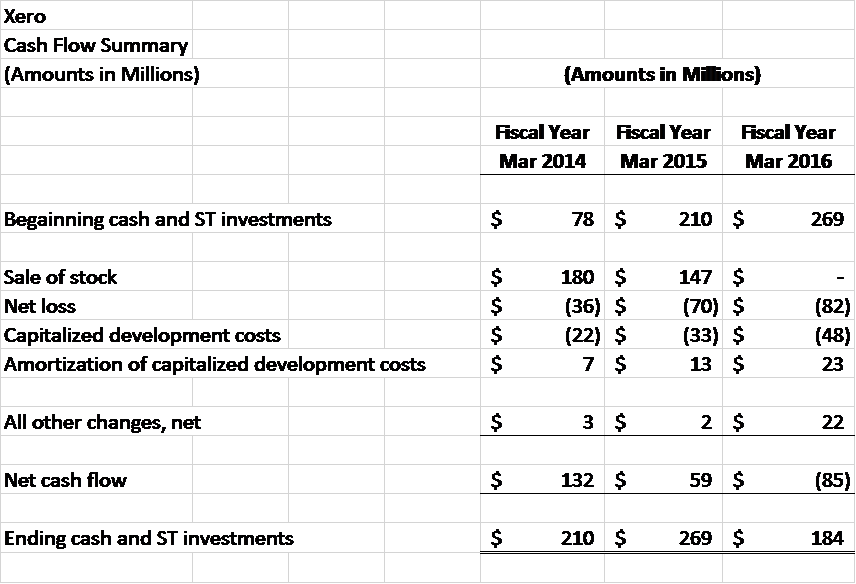

The Statement of Cash Flows Report in Xero

If you run the Statement of Cash Flows report in the online accounting software Xero, the words “cash flow” appear more often. But there is no line with the two-word description “cash flow”. You will see line items like “Net Cash Flows from Operating Activities”, “Net Cash Flows from Financing Activities”, and “Net Cash Flow”.

In the report from Xero, “net cash flow” has a dollar amount associated with it. That number is the same as the “Net change in cash for the period”.

Here is an example from the Statement of Cash Flows report in Xero (with the column for amounts excluded):

The “net cash flow” description can be helpful because it makes it clear that it is referring to a net number. It is referring to the concept of taking the dollar amount of cash coming in the door and subtracting all the cash that went out the door.

Or, as a shortcut, you can take the cash balance at the end of the month and subtract the cash balance at the beginning of the month. That’s the change in cash, the net cash flow you might say, for the month.

Is a Decline in Your Cash Balance Always Bad?

If you started the month with $375,000 and ended with $425,000, then the change in cash was $50,000. Your cash balance went up. If you had ended the month with $300,000, then the change in cash would have been ($75,000). Your cash balance went down.

But, and this is a really big but, you don’t know whether that change in cash (whether up or down) is a good thing or a bad thing.

Here is an example from a small business that will help you see why a decline in your cash balance is not always bad.

The business started the month with $200,000 of cash and ended the month with $150,000 of cash. Their cash balance went down by $50,000. Their “net cash flow” was negative. They have less cash (money) at the end of the month than when they started the month? Question: Is that a bad thing? Answer: No!

Their profit came in well above expectations, they did a good job collecting on their accounts receivable from customers, and they paid off all their debt to the tune of $100,000 during the month.

Becoming debt-free in their business has been a goal of theirs for three years now. Over the past three years they have paid off $500,000 of debt. Now they have zero debt. They feel absolutely on top of the world. Their business is getting stronger and stronger financially and their future is looking even brighter.

BUT, they have less money in the bank at the end of the month than when they started the month. Are they unhappy? NO. They did that by design. It was intentional. It was part of their larger strategy to improve the financial health and wellness of their business. It was smart.

And they were very happy about their cash flow for the month.

Making Cash Flow Simple and Easy to Understand

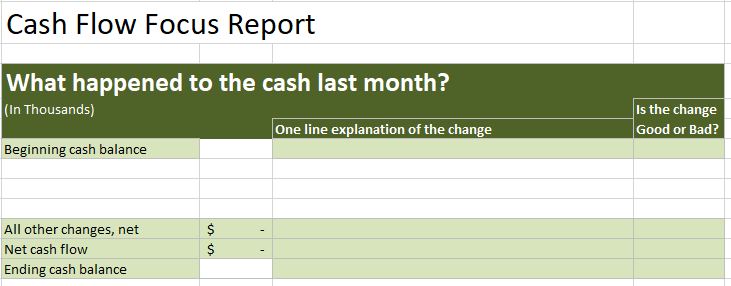

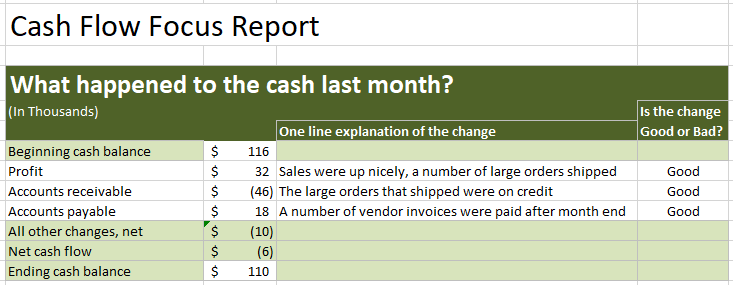

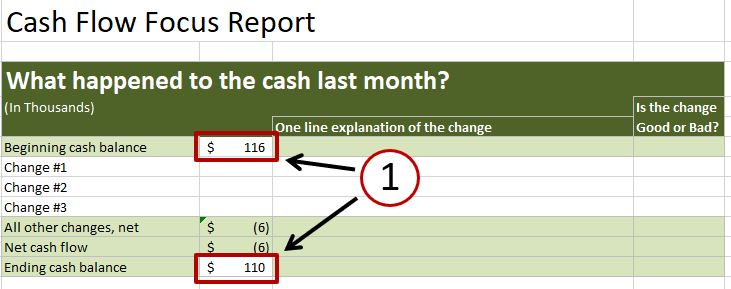

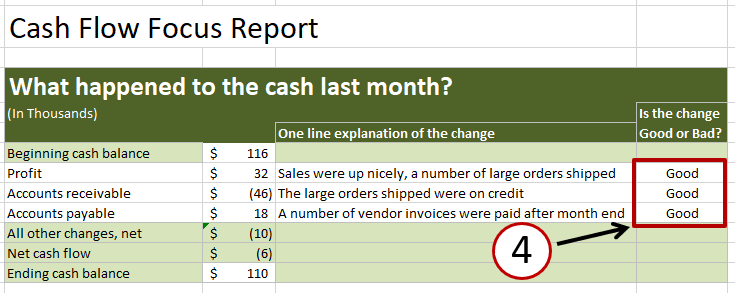

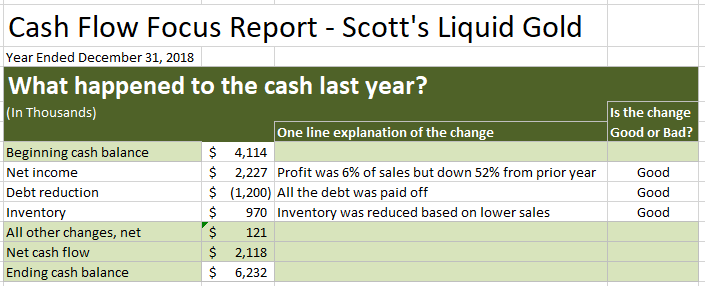

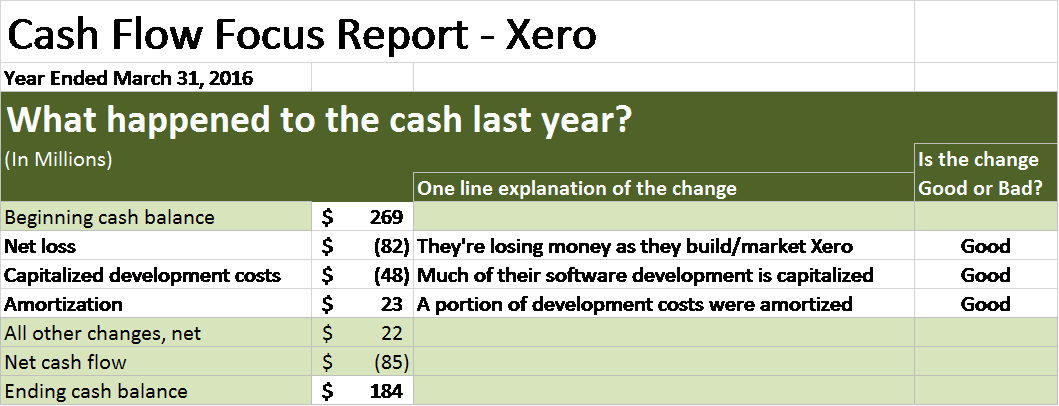

In my next post in this series on making cash flow simple and easy to understand, I show you how to understand your cash flow using the 2-minute conversation.

The 2-minute conversation is where you understand your cash flow for the month so well that you can explain it to your business partner, banker, maybe even your spouse, in a simple 2-minute conversation.

Simple, fast, and focused. 😊

Philip Campbell is an experienced financial consultant and author of the book A Quick Start Guide to Financial Forecasting: Discover the Secret to Driving Growth, Profitability, and Cash Flow and the book Never Run Out of Cash: The 10 Cash Flow Rules You Can’t Afford to Ignore. He is also the author of a number of online courses including Understanding Your Cash Flow – In Less Than 10 Minutes. His books, articles, blog and online courses provide an easy-to-understand, step-by-step guide for entrepreneurs and business owners who want to create financial health, wealth, and freedom in business.

Philip’s 35 year career includes the acquisition or sale of 35 companies (and counting) and an IPO on the New York Stock Exchange.

Understanding Your Cash Flow – In Less Than 10 Minutes

This online course teaches you the step-by-step process for simplifying your cash flow. I walk you through each lesson while you watch, listen, read and try it yourself using your own cash flow numbers.

The course is very affordable. And there are also some coaching options available if you would like to get up and running fast.

It’s a fantastic way to learn the process.

I take all the risk out of your purchase because I include a 100%, no questions asked, money-back guarantee. You love it or you get your money back in full. Period.

There are two things that are very unique and exciting about this online course.

1. I’ll show you how to understand your cash flow in less than 10 minutes

2. I’ll show you how to explain what happened to your cash last month to your business partner or banker (or maybe even your spouse) in a 2-minute conversation.

I take off my CPA hat and I speak in the language every business owner can relate to. No jargon. No stuffy financial rambling. Just a simple, common sense approach that only takes 10 minutes a month.

Here is how one business owner describes the benefits of the course.

“I googled cash flow projections and found your website online and it appealed to me mainly due to the fact that you speak in laymen’s terms in a way that a non-financially trained person can understand.

The fact that you said you can understand your cash flow in less than 10 minutes a month was also a big reason I bought it. And the fact that you acknowledge that most accountants and CPA’s speak in terms that the normal owner cannot understand and that you would be able to put things in understandable terms really got me.

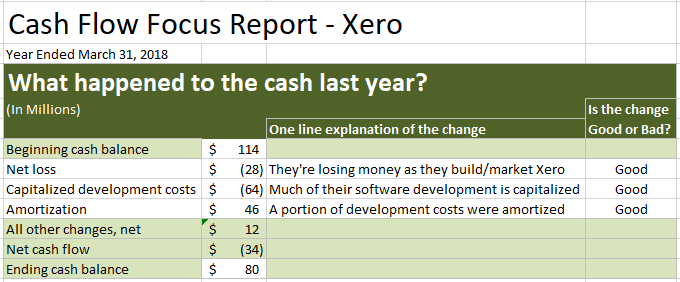

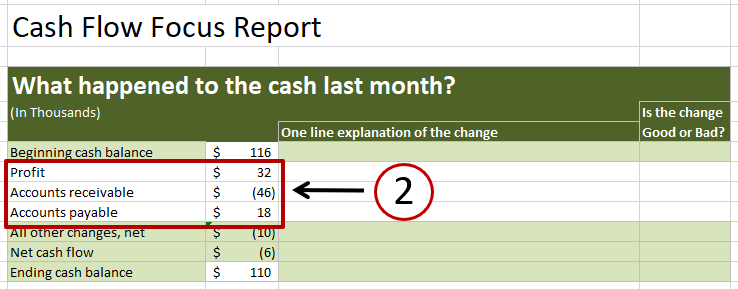

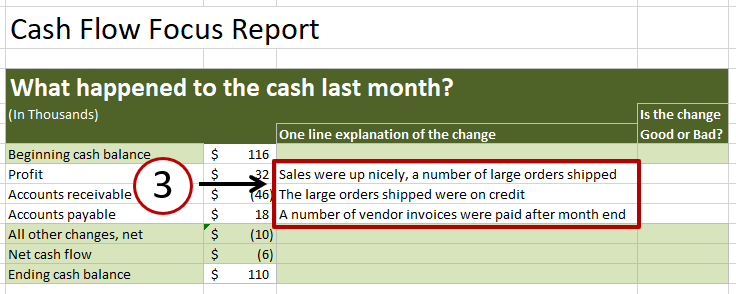

The monthly cash flow focus report was the best feature for me because learning to do it helped me understand my cash flow statements and the biggest drivers of cash flow.

Another significant benefit is the definitions of cash flow drivers and descriptions of how a negative or positive sway in cash within those drivers affects cash flow. Being able to see at a quick glance monthly what happened to your cash using the focus report is a huge benefit.”