I learned early in my career as a CPA and a CFO that the secret to making the cash flow of a business easy to understand, was to simplify it down to a non-accountant, simple, common sense message that a business owner or CEO could easily relate to.

I routinely heard business owners say, “I know my business is profitable… but for some reason cash is always tight.” They felt like they had some sort of “cash flow leak” somewhere in their business. But they were not sure where the leak was. Or why it was happening. Or how to fix it.

With no real answers or solutions to their problem, their tendency was to “punt” on understanding what was going on with the cash, and just hope that the cash flow would eventually take care of itself.

Here’s What’s Causing the Problem

There are four reasons cash flow is so confusing (and a bit convoluted):

- Profit (or loss) is not cash flow – this is the single biggest source of confusion.

- There is no clear definition of cash flow – most everyone understands profit or loss because it is one number you can see on a P&L. But cash flow is not quite that simple. It’s not a single number.

- An increase in cash is not always good… and a decrease in cash is not always bad – If cash was down one month because you decided to pay down debt quickly, that would be a good thing. On the other hand, if a reduction in cash was due to the bank threatening to pull your line of credit unless you paid the debt down ASAP (and it is going to put you in a bind financially), that would be a bad thing. And if you increased your cash one month because you didn’t pay your vendors, that would be a bad thing.

- Accountant speak (and financial statements) – the last issue is as accountants we have done a poor job of making cash flow, and financial statements in general, easier to understand.

The Cash Flow Focus Report to the Rescue

I developed the Cash Flow Focus Report to solve this problem. It’s a simple, common sense approach to understanding your cash flow that only takes 10 minutes a month. It brings focus to your cash flow, simplifies your life, and leads to an understanding and sense of confidence that you will find freeing.

A simplified approach to understanding your cash flow should work like this:

- You should be able to explain what happened to your cash last month in a 2-minute conversation (to yourself, your business partner, your CEO, your banker or maybe even your spouse).

- It should only take 10 minutes of work to get to that answer

To achieve both of those objectives you have to simplify the process (so it only takes 10 minutes a month) and you have to ensure the process provides information about your cash flow that is easy-to-understand (so you can explain what happened to the cash in a 2-minute conversation).

Here’s how you do that:

- Focus on only the three largest drivers (changes) in cash last month

- Write a one-line explanation of each change

- Determine whether each change is good or bad

You will be surprised at the insights you discover about your cash flow each month by following those three simple steps.

The Cash Flow Focus Report

The Cash Flow Focus Report provides the solution by bringing common sense principles together with a simplified presentation of cash flow. It provides the structure and format to help you keep it simple.

- It could fit on an index card (or even a Post-It note) so it helps keep the work to 10 minutes or less. (I prefer the spreadsheet version though so I can easily save it each month.)

- It provides three rows so you can enter the three largest changes in your cash for the month you are looking at. (I pull the three largest changes in cash from the standard Statement of Cash Flows report from your accounting system. You can grab the three largest changes then toss the Statement of Cash Flows report.)

- It forces you to think about what caused each change and write a one-line explanation. (You can’t provide a long-winded answer in only one sentence, right.)

- You evaluate and write down whether each change is good or bad. (Not all changes that reduce cash are bad and not all changes that increase cash are good.)

For one business owner, their 2-minute conversation (after completing the Cash Flow Focus Report) looked like this:

“We made $350,000 over the last six months but cash was down by $50,000. The reason for the reduction in cash (despite strong profits) was the new facility we purchased for the Texas expansion and an increase in accounts receivable based on landing ABC Co. as a new customer.”

A Small Business Example

Let’s start by looking at a real-life small business example.

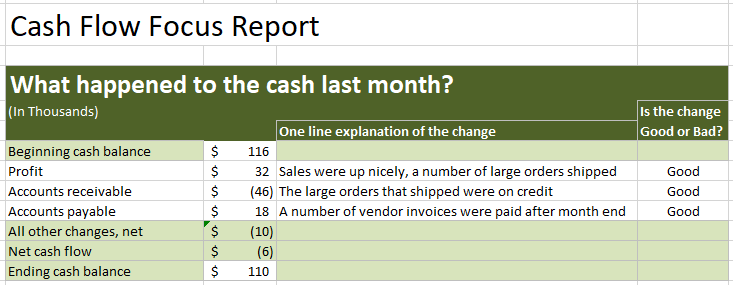

The business does just under $2,000,000 in sales each year. For the month that just ended, the owner’s P&L showed a profit of $32 thousand. But their cash balance went down during the month by $6 thousand (from $116 thousand down to $110 thousand).

With the Cash Flow Focus Report, we are going to answer the question, “What happened to the cash last month?”

And more specifically, the owner wanted to answer the question, “How did I make money last month but have less cash in the bank as a result? How does that happen?”

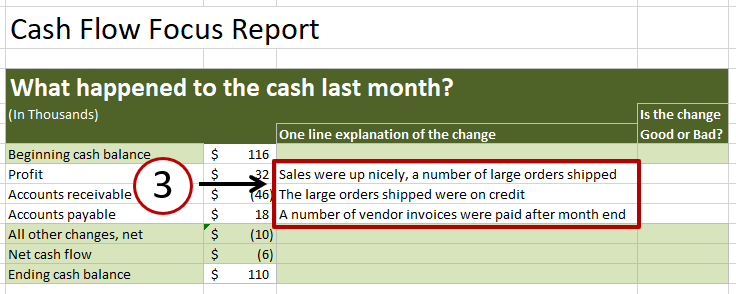

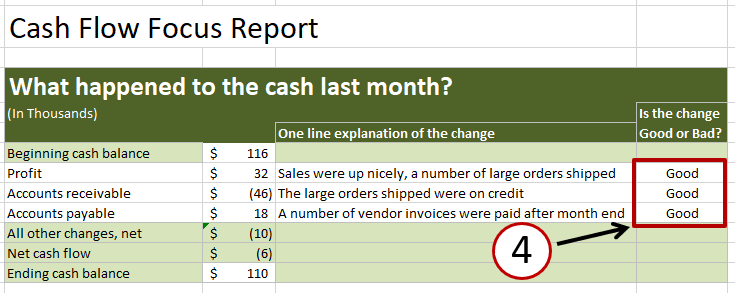

Here is the completed focus report:

The 2-Minute Conversation, the result of completing the focus report, looks like this:

“We made good money this month on higher sales. We shipped a number of large orders to a great customer. But those orders were sold on credit (we invoiced the customer on 30-day terms) so we did not receive the cash this month. Accounts payable was up during the month because we had a number of vendor invoices that were entered as expenses, but they will not be paid until next month. As a result, the cash balance went down during the month from $116 thousand to $110 thousand. The good news is we expect to receive the cash from the large orders next month so the “timing difference” in our cash flow should turn around nicely next month.”

The Step-By-Step Process

Now let’s walk through each step in completing the Focus Report using our example company.

Print the statement of cash flows report from your accounting system. Shortly after the end of the month, once you have reviewed your financial statements and closed the month, you are ready to print the Statement of Cash Flows report. In QuickBooks, the report is in the Company & Financial section under Reports.

Create a blank Cash Flow Focus Report. You can create one on paper or in a spreadsheet. (You can download a PDF or XLSX version of the report. Get the PDF file if you are going to do the report in writing. Get the XLSX if you want to enter it there and save a copy.)

Here are the four steps for completing the Focus Report together with the actual focus report for our example company.

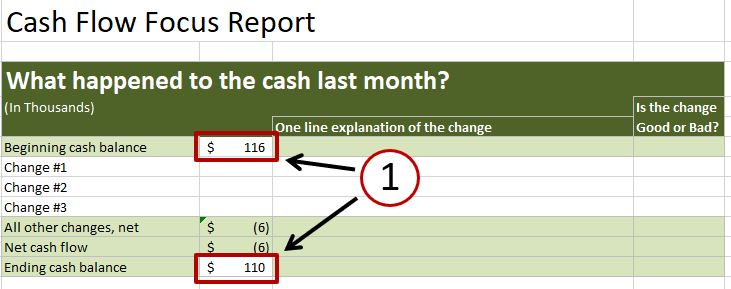

Step 1: Drop in the beginning cash balance and the ending cash balance. Round the numbers from the cash flow statement in thousands. This is an important component of keeping things simple. So, a beginning cash balance of $116,235 would be $116. (The XLS has a formula for automatically calculating “All other changes, net” and the “Net cash flow” lines.)

As you can see, there is not much to step 1. Just enter the beginning cash balance for the month and the ending balance (from your financial statements).

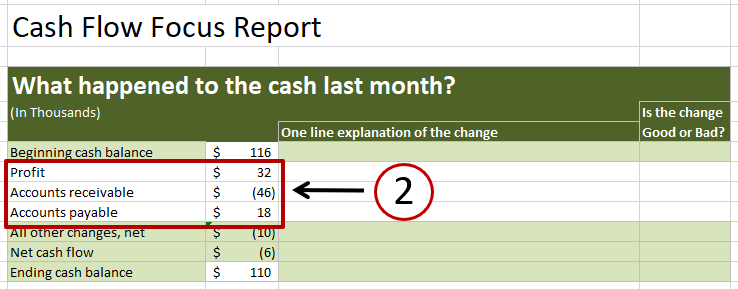

Step 2: Identify the three largest drivers (changes) in cash. Find the three largest changes of cash for the month from the Statement of Cash Flows you printed from your accounting system. Enter the category of change (like accounts receivable, profit or loss, inventory, accounts payable, debt service, etc.) and the amount of the change. Use the same sign (positive or negative) as is on the cash flow statement.

While the Statement of Cash Flow you print from your accounting system may have 20 or more lines of numbers, we only pull in the three largest drivers (changes) of cash on the focus report. By just pulling the three largest drivers of cash, we are focusing on the key drivers that impacted your cash for the month.

Step 3: Write a one-line explanation of the change. You will do this for each of the three largest changes. Keeping the explanation to one-line is important because it forces you to simplify your explanation.

If there is a stumbling block in your way to writing your explanation of each change, it’s the fact that there are lots of different drivers of cash flow. And understanding each change means you need to learn a little about how financial statements work. That’s a good thing though. You are severely handicapped in business if you do not have a good working knowledge of your financial statements.

The beauty of the focus report is that you do not have to learn all the different drivers of cash flow all at once. You can learn them in bite-sized chunks. A little bit at a time. Trying to learn about all of them at once is like trying to drink water from a firehouse. It doesn’t work (and it’s not real smart).

Step 4: Determine whether each change in cash is good or bad. You will do this for each of the three largest changes in cash. For example, if cash was down one month because you decided to pay down debt, that would be a good thing. If you increased your cash one month because you didn’t pay your vendors, that would be a bad thing.

The key point to keep in mind in evaluating each change in cash is that not all changes that reduce cash are bad… and not all changes that increase cash are good. Generally speaking, a change that catches you off guard, or might spell trouble financially, would be labeled as bad. You’ll be surprised what you learn about your cash flow as you think about whether a specific change in cash is good or bad.

The Cash Flow Focus Report for Scott’s Liquid Gold, Inc (a Small Public Company)

I came across a public company recently, Scott’s Liquid Gold, Inc and I decided learn more about the company and determine whether I wanted to invest in the company and become a shareholder. The first thing I do when I’m looking at making an investment in a company (public or private), is create the focus report. In a situation like that, I use the focus report to answer the question, “What happened to the cash last year?”

Take a look here at how fast and easy we create insight about this company’s cash flow.

Solving the Mystery of Cash Flow

After you use the Cash Flow Focus Report for a few months, something interesting will start to happen. The mystery around cash flow begins to disappear.

You will find yourself spending less time worrying about what’s going on with the financial side of your business. You will begin making more confident decisions because you have a better understanding of how your day-to-day business decisions impact your cash flow (and your cash balance).

And best of all, you will free up more of your time to do the things you really enjoy in the business. And it all starts with learning a simple approach to understanding your cash flow.

Using the Cash Flow Focus Report is the fastest way to zero in on what’s really going on with your cash flow. You will be surprised how quickly it points you to problem areas (and therefore to profit and cash flow improvement opportunities).

Understanding Your Cash Flow – In Less Than 10 Minutes

I created a short, video-based, online course to help you implement the Cash Flow Focus Report in your business. The promise of the course is to show you how to understand your cash flow in less than 10 minutes a month.

The cost is about the same as a small book. And it comes with my no questions asked, 100% money-back guarantee. If you don’t LOVE it, I’ll refund your purchase super-fast.

Philip Campbell is an experienced financial consultant and author of the book A Quick Start Guide to Financial Forecasting: Discover the Secret to Driving Growth, Profitability, and Cash Flow and the book Never Run Out of Cash: The 10 Cash Flow Rules You Can’t Afford to Ignore. He is also the author of a number of online courses including Understanding Your Cash Flow – In Less Than 10 Minutes. His books, articles, blog and online courses provide an easy-to-understand, step-by-step guide for entrepreneurs and business owners who want to create financial health, wealth, and freedom in business.

Philip’s 30 year career includes the acquisition or sale of 33 companies (and counting) and an IPO on the New York Stock Exchange.

This book provides a straightforward, easy-to-understand guide to one of the most powerful financial tools in business: a reliable financial forecast. It will transform the financial future of your company and help you make better, faster, smarter financial decisions.

Too many entrepreneurs and CEOs today are feeling more like passengers than drivers in their business. They’re staring at their rearview mirror as they bounce along in the passenger seat. Their company is careening along on the highway of business as they wonder and worry about where their business might end up financially.

A reliable financial forecast solves this problem by providing a clear view through the financial windshield of your business. It creates the visibility and clarity you need to drive your company toward a bigger and brighter financial future.

What if you had answers to questions like:

What’s about to happen to my profitability and cash flow?

How much cash can we distribute to the owners of the business?

How long will it take to pay off our debt?

What will our taxable income be this year?

A reliable financial forecast puts the answers to these questions at your fingertips. It helps you take control of your profitability and cash flow because it gives you answers to the most important financial questions you have to deal with every day.

Put yourself in the driver’s seat of your business by tapping into the unique and exciting benefits that financial forecasting can unlock for you.

Buy the Kindle version at Amazon.

Buy the book at Barnes & Noble.

If you already own the book, the free tools and downloads are waiting for you. Click here to access the financial spreadsheets, examples, rapid learning guides, and more.

Leave a Reply