I believe that goals are magic.

Much of my thinking about goals was influenced in a big way by the work of Brian Tracy when I was in my 20s and 30s. That was way back in the 1980s and 1990s. I loved his audio program (on cassette back then), The Psychology of Achievement, produced in 1984 by Nightingale Conant.

I listened to those audio cassettes over and over on my daily commute in my car. I was a big fan. I always had lots of audio programs in my car that I listened to repeatedly. Nightingale Conant produced audio programs by Brian Tracy and many other popular business and self-improvement authors. Those audio programs turned out to be one of the benefits of having a fairly long drive to and from the office each day in Houston. I soaked in those audio programs and latched on to their teaching.

Here is a quote from Brian Tracy that embodies the spirit and power of goals that has stuck with me all these years:

“The reason that we set goals is to enable us to control the direction of change in our lives, and to assure that the direction of change in our lives is predominantly toward improvement rather than toward a deterioration in our conditions.”

For me, goals became the tool by which I could grow and succeed in my career. I believed that I could use goals to ensure that my trajectory as a young CPA was toward becoming better and better at my craft. I could steer my career upward and onward so that as each year went by, I would feel confident that I was increasing my ability to add value in the business world.

I had a burning desire to be successful and make money in business, and I believed that goals were one of the tools to help me make that happen.

Mental Laws

Maximum Achievement is the book by Brian Tracy that goes deeper into the principles from his Psychology of Achievement audio program. (The book was published in 1993). Here is a quote from the book about the concept of “mental laws” that went hand-in-hand with the power of setting goals.

“There are two types of laws in the universe: man-made laws and natural laws. You can violate man-made laws, like traffic laws, and you may or may not get caught. But if you attempt to violate natural laws, you get caught every single time, without exception. Natural laws, in turn, can be divided into two categories: physical laws and mental laws. The operation of physical laws, like those governing electricity or mechanics, can be proven in controlled experiments and practical activities.

Mental laws, however, can only be proven by experience and intuition, and by seeing them work in your own life.

It doesn’t matter whether you know about gravity, or whether you agree with gravity, or whether anyone ever told you about gravity when you were growing up. The law is neutral. It works for you everywhere, regardless of whether you know about it or whether it is particularly convenient for you at that moment.

Mental laws, although their physical affects cannot be seen quite so easily, also work 100% of the time. Because they are central to your happiness, it is essential that you become familiar with them and integrate them into everything you do.”

The idea that there were mental laws at work in business and in life has always intrigued me. It was exciting to consider the notion that how you think, and what you think about, has a strong influence on how things might develop in the future. It had a bit of a “woo-woo” feel to it. But, at the same time, it also seemed very logical to me.

I took to heart Brian’s statement that “mental laws, however, can only be proven by experience and intuition, and by seeing them work in your own life.” I also put a lot of stock in his statement about the mental laws when he said, “it is essential that you become familiar with them and integrate them into everything you do.”

Three Important Mental Laws

Here is a short description from Maximum Achievement about three of the mental laws that influenced me the most early in my career:

“The Law of Control says that you feel positive about yourself to the degree to which you feel you are in control of your life. And you feel negative about yourself to the degree to which you feel that you are not in control, or that you are controlled by some external force, person or influence.

It is impossible for us to control our lives without goals. And it is impossible for us to feel good about ourselves unless we feel that we are in control of the direction of our lives and of our destinies.

The Law of Expectations says that whatever you expect with confidence becomes your own self-fulfilling prophecy. To put it in another way, what you get is not necessarily what you want in life, but what you expect.

Your expectations exert a powerful, invisible influence that causes people to behave and situations to work out as you anticipated. In a way, you are always acting as a fortune-teller in your own life by the way you talk about how you think things are going to turn out. You can never rise any higher than your expectations of yourself. Since they are completely under your control, be sure that your expectations are consistent with what you want to see happen.

The Law of Attraction says that you are a living magnet. You invariably attract into your life people and situations in harmony with your dominant thoughts. Your thoughts are a form of energy that vibrates at a speed determined by the level of emotional intensity accompanying the thought.”

I like to believe that your subconscious mind will work on goals and solutions for you while you aren’t even thinking about them. Like an auto-pilot that is homed in on the destination and constantly course correcting to help the pilots get you to your destination safely.

Programming Goals into Your Mind

I decided early on to put Brian Tracy’s teaching on the power of affirmations to work in my life. I figured the worst that could happen is I would try it and discover that maybe it didn’t work so well for me. That seemed like a very small risk for me to take. Lots of potential upside, and very little, if any, downside.

One specific exercise that Brian teaches is to write down affirmations to help you “program” your goals into your mind. Here is a quote from his book about the power of affirmations:

“Affirmations are based on the three “P’s.” They are positive, present tense and personal. Affirmations are strong statements or commands from your conscious mind to your subconscious mind. They override old information and reinforce new, positive habits of thought and behavior.

One of the most powerful influences on your subconscious mind is what you say to yourself and believe. Affirmations like “I can do it” or “I earn $XXX per year” or “I weigh XXX pounds” can bring about lasting changes in your self-concept and in your results.

This is a way of “telling the truth, in advance.” This is how you convince your subconscious mind that the condition you desire already exists. Your subconscious then makes whatever changes are necessary, internally and externally, to align your inner world with your desired outer reality.

Remember, all change is from the inner to the outer. All change begins in the self-concept. You must become the person you want to be on the inside before you see the appearance of this person on the outside.

Everything that happens to you, everything you become and accomplish is determined by the way you think, by the way you use your mind. As you begin changing your mind, you begin changing your life.”

Goals Are the Starting Point

Earl Nightingale, in his groundbreaking audio program (from Nightingale Conant of course) Lead the Field, defines success this way:

Success is the progressive realization of a worthy goal.

“It means that anyone who’s on course toward the fulfillment of a goal is successful. Now, success doesn’t lie in the achievement of a goal, although that is what the world considers success. It lies in the journey toward the goal.

We’re successful as long as we’re working towards something we want to bring about in our lives. That’s when the human being is at his or her best.”

I like this definition of success because it points out that success is as much about the “journey toward the goal” than the actual achievement of the goal. But it makes it clear that it all starts by having a worthy goal in the first place. You must have something that is important to you to strive toward in order to begin your journey. You have to define “where you are going.” Then monitor and savor your progress along the way.

I have found Nightingale’s statement “We’re successful as long as we’re working towards something we want to bring about in our lives” to be very true in career, business, and life. Setting “worthy goals”, and thinking about them all the time, is not only fun and engaging… it is a big part of what success is all about… “the progressive realization of a worthy goal”.

A Young CPA on a Mission

As a young accountant way back in 1984, I set a goal to make $30,000 by the time I was 30. It was one of the first very specific, career oriented, goals I remember writing down and etching into my brain.

I was 23 years old at the time and working in a small CPA firm in Beaumont Texas. I was one year out of college with my degree in accounting and I had my sights set on becoming a CPA. My income that year was $21,377 (which included a lot of overtime).

I had no specific plan or path as to how I would increase my pay by almost 50%. But I knew I wanted to make more money. And “30 by 30” had a nice ring to it. So, I set the goal and let my subconscious know it was very important to me. I thought about the goal often, focused on growing and learning in my new career, and became intent on passing the CPA exam. (After more than one attempt at the exam, I became a CPA in 1985.)

In 1986, Lamar University in Beaumont Texas, the college I had graduated from three years prior, allowed me to interview with some international accounting firms that were coming to campus to interview new graduates. At the time, the Big 8 CPA Firms (as they were known back then) hired people fresh out of school rather hire experienced accountants or CPAs. I had graduated three years prior, and had become a CPA, so I didn’t exactly meet their new hire profile.

But to my delight, by the end of 1986, I had convinced a partner at Arthur Andersen in Houston, Texas to hire me and take a chance on an “experienced” CPA rather than a new graduate.

My pitch to the partner at Arthur Andersen was simple: “Pay me the same money you pay new graduates (which was well below my $30,000 target) and I would show them in short order that I could add value at a much higher level than their new graduates.” My plan was to prove I could live up to my promise, then sit down with them and talk about the merits of increasing my pay to better match the value I was providing.

I felt confident that my pitch would increase my chances of getting the job. And I felt that getting the job and being in the middle of the action in an international accounting firm in Houston, Texas would help me get the experience and training I wanted to take my business skills and abilities to a higher level. It would help me add more value in business. And increasing my ability to add more value would ultimately help me hit my larger financial goals.

My income in 1988, at 27 years old, came in at $32,430. I had beat my “30 by 30” goal and beat the deadline. It felt good to set a goal, then look back on all the interesting turns and twists that ultimately led to hitting the goal (and there was plenty of turns and twists along the way). One thing I learned in that process was to think bigger, and more aspirational, about my financial goals in the future.

The New Goal – A Net Worth of $1 Million… or More

My next big picture financial goal was to create a personal net worth of $1,000,000. I set that goal around 1990 or so. This time my goal was about having money rather than just making money.

My net worth goal was much bigger and much more aspirational than my goal for making more money. I didn’t put a specific timeframe on achieving the goal. Mostly because it was such a big goal for me at the time and it wasn’t practical to think I could chart a precise path or timeframe for achieving it. I knew it would require making more money, spending less than I earned, paying off debt, investing wisely, and catching some good breaks along the way. But there was no timeframe because it was more of an aspirational goal. I didn’t really know if I could even achieve it. But if I knew that if I did achieve it, it would take time.

At the time, I had what I jokingly refer to in hindsight as a “not worth” rather than a net worth. My personal balance sheet had more liabilities and debt on it than assets. I had a negative net worth. A net worth LESS than ZERO! More liabilities and debt than assets.

There was no clear path at all as to how I might go from a “not worth” to a $1,000,000 net worth. But growing a healthy net worth that I could be proud of was VERY important to me. As a result, I thought of the goal more in terms of planting a seed in my subconscious mind that would develop and grow in the years to come rather than something to be achieved right away. I wanted to experiment with the idea that sometimes you can develop a lofty ideal or objective in your mind and the goal itself turns into a magnet of sorts that begins pulling you toward it over the years.

So, I took Brian Tracy’s advice. I thought about my net worth goal often. I probably wrote my net worth goal down on paper hundreds of times to make it a part of my conscious and subconscious mind.

I later revised my net worth goal to add “or more” to it because I realized that I did not want to put a lid on what I was going after. As I observed my progress toward the goal over the years, I realized that it needed to continue to expand so it retained the aspirational nature of the original goal.

And now that 30 years has passed, I have changed the dollar amount of the goal. I still have a personal net worth target. I just keep evaluating the number to make sure I am thinking about it and feeding my subconscious mind with an enjoyable goal to move toward.

Because I have learned over the years that the real fun, the real reward, is the journey toward the goal. Hitting the goal feels good. That’s for sure. But once you hit your target, once you achieve your goal… it’s time to set another goal. It’s time to reset so you can begin another journey.

And it doesn’t always matter whether you hit each succeeding goal. Goals represent a process and a journey, not a destination. 🙂

Setting Financial Goals and Targets in Your Business

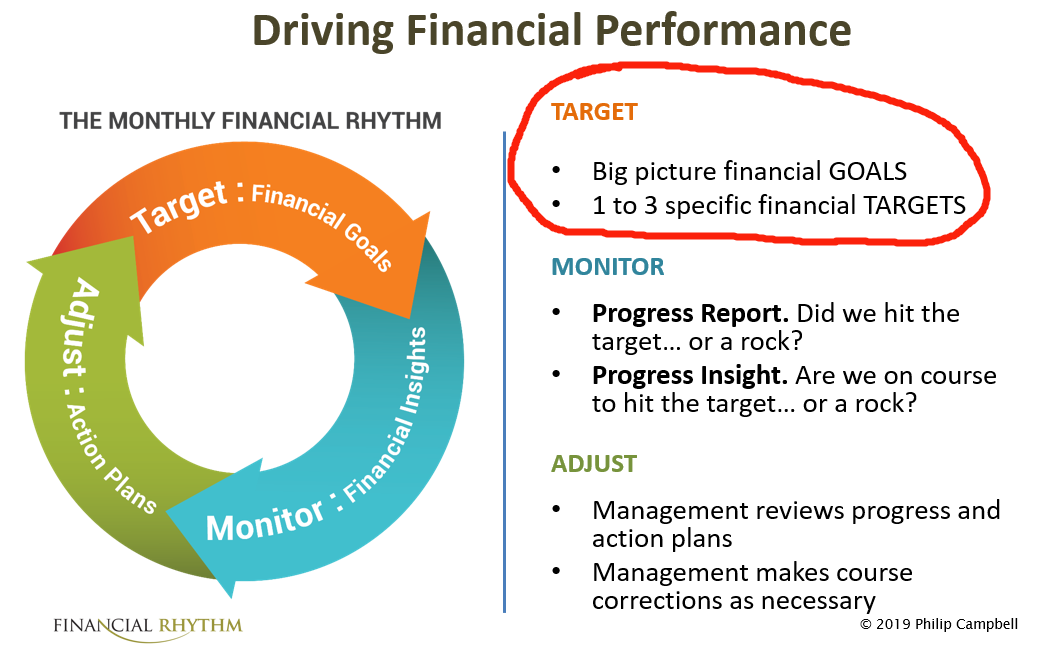

Business and money move in a rhythm. I refer to this natural Monthly Financial Rhythm in business as the Target, Monitor, Adjust cycle. It’s about setting financial goals and targets, monitoring actual and forecast financial results, and making adjustments in strategy and execution inside the company to achieve the goals and targets.

The Target portion of the Monthly Financial Rhythm begins with setting some big picture financial improvement goals. Generally, these are goals that will take 12 months or more to achieve. Then you set 1 to 3 specific targets that will help you make progress toward those goals. The targets are usually set for the next 3 months.

I developed the Monthly Financial Rhythm as a result of my beliefs about, and my experience with, the magic of goal setting. It evolved over my years as an advisor and a financial officer inside companies. It fit perfectly with my desire to put the power of goals to work inside a business where we were trying to grow and improve financial performance.

The objective in setting goals and targets goes back to what Brian Tracy taught me so many years ago. I’ll modify his statement a tiny bit by substituting the word “business” where he says “life”. When I do that, his teaching about why we set goals looks like this:

“The reason that we set goals is to enable us to control the direction of change in our business, and to assure that the direction of change in our business is predominantly toward improvement rather than toward a deterioration in our conditions.”

We know things are changing all around us in business. The competition is getting better. Technology is changing how we work and how we sell our products and services. Expenses are always going up. Like it or not, change is happening in our business.

Our responsibility, your responsibility, as a business owner is to “control the direction of change in your business and assure that the direction of change is predominantly toward improvement.”

There’s magic in setting financial goals and targets in business and using them to drive your business toward the financial success you have envisioned.

Now is the perfect time to set very specific financial improvement goals and see if you can create some magic this year. 🙂

Philip Campbell is an experienced financial consultant and author of the book A Quick Start Guide to Financial Forecasting: Discover the Secret to Driving Growth, Profitability, and Cash Flow and the book Never Run Out of Cash: The 10 Cash Flow Rules You Can’t Afford to Ignore. He is also the author of a number of online courses including Understanding Your Cash Flow – In Less Than 10 Minutes. His books, articles, blog and online courses provide an easy-to-understand, step-by-step guide for entrepreneurs and business owners who want to create financial health, wealth, and freedom in business.

Philip’s 30 year career includes the acquisition or sale of 33 companies (and counting) and an IPO on the New York Stock Exchange.

A Quick Start Guide to Financial Forecasting

Discover the Secret to Driving Growth, Profitability, and Cash Flow Higher

This book provides a straightforward, easy-to-understand guide to one of the most powerful financial tools in business: a reliable financial forecast. It will transform the financial future of your company and help you make better, faster, smarter financial decisions.

Too many entrepreneurs and CEOs today are feeling more like passengers than drivers in their business. They’re staring at their rearview mirror as they bounce along in the passenger seat. Their company is careening along on the highway of business as they wonder and worry about where their business might end up financially.

A reliable financial forecast solves this problem by providing a clear view through the financial windshield of your business. It creates the visibility and clarity you need to drive your company toward a bigger and brighter financial future.

What if you had answers to questions like:

What’s about to happen to my profitability and cash flow?

How much cash can we distribute to the owners of the business?

How long will it take to pay off our debt?

What will our taxable income be this year?

A reliable financial forecast puts the answers to these questions at your fingertips. It helps you take control of your profitability and cash flow because it gives you answers to the most important financial questions you have to deal with every day.

Put yourself in the driver’s seat of your business by tapping into the unique and exciting benefits that financial forecasting can unlock for you.

Buy the Kindle version at Amazon.

Buy the book at Barnes & Noble.

If you already own the book, the free tools and downloads are waiting for you. Click here to access the financial spreadsheets, examples, rapid learning guides, and more.