Here is the general rule I use to help business owners think about how much cash they should keep in their business. And how much of their cash they can safely consider “excess” and therefore available to distribute to owners.

- Minimum cash target. This is the balance you work hard to never go below. I generally set this at about one month or so of operating expenses. Trying to run your business with less than that amount of cash in the bank is dangerous. The smallest hiccup in sales or collections from customers can wreak havoc. It creates unnecessary stress and makes your life much harder than it needs to be because you are constantly dealing with a cash balance that makes it hard to get everyone paid on time. It is much better to accept the reality that you need money in the bank to run a business… and one month of operating expenses is generally a good number to use as a minimum.

- Comfortable range. This is a range of cash balances that you operate the business with most of the time. When you are operating in this range, you feel good about your cash balance. You are not worrying about what happens if customers are a little slow in paying in a particular week. You have a healthy cash balance and a nice cushion to protect you.

- Excess cash. This is the amount that, when the cash balance on your balance sheet goes above this number, you have more cash on hand than the business needs for current or future uses. That excess cash is the amount available to distribute to the owners of the business as a reward for their ownership position in a strong company.

Here is an example.

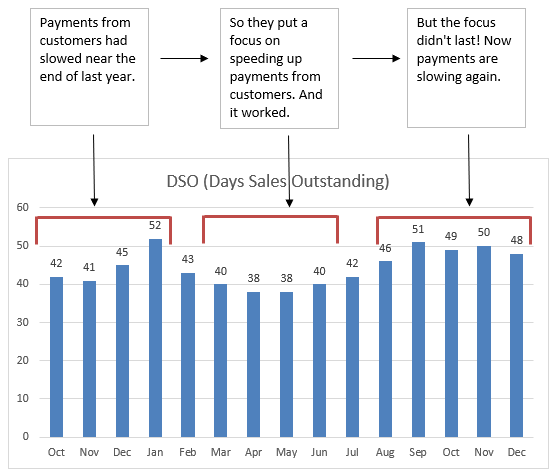

Tim’s business does about $3.5 million in annual revenues. His business provides services primarily to manufacturing companies. Much of the work is project driven where customers are invoiced based on project milestones and some are invoiced based on time incurred. They don’t carry inventory but they do have some fairly large accounts receivable. DSO routinely runs at 50 to 60 days.

Here is how Tim sets his cash targets using this approach.

- Minimum cash target. His monthly operating expenses usually come in between $190k and $225k. He set his minimum cash target at $300k. That is about 1.5 months of operating expenses. The fun thing about Tim is that the $300k was a little too low for him at first. Tim is the kind of business owner that likes having money in the bank. He had run the business in years past on skinny bank balances… and learned that wasn’t the approach he was most comfortable with. He decided that 1.5 months of operating expenses was a good place to start as a minimum.

- Comfortable range. He set his comfortable range at $300k to $700k. The cash balance generally runs in the $400k range during the first part of the year and grows past the $700k range near the end of the year. He makes owner distributions during the year for taxes because the company is an S Corporation. Healthy profits and consistent collections on their accounts receivable add nicely to their cash balance as the year progresses.

- Excess cash. He set the excess cash number at cash over $700k. Unless there was an exciting growth or strategic opportunity on the horizon, he is comfortable considering the cash above $700k to be generally available to distribute to the owners.

I have found this approach to thinking about your cash balances to be super-helpful for business owners and financial people alike.

It helps when you are forecasting cash flow, making decisions about how much cash that might be available to distribute to owners during the year, and in general evaluating the financial health and well-being of your company.

Give it a try and see how you like it.

Philip Campbell is an experienced financial consultant and author of the book A Quick Start Guide to Financial Forecasting: Discover the Secret to Driving Growth, Profitability, and Cash Flow and the book Never Run Out of Cash: The 10 Cash Flow Rules You Can’t Afford to Ignore. He is also the author of a number of online courses including Understanding Your Cash Flow – In Less Than 10 Minutes. His books, articles, blog and online courses provide an easy-to-understand, step-by-step guide for entrepreneurs and business owners who want to create financial health, wealth, and freedom in business.

Philip’s 35 year career includes the acquisition or sale of 36 companies (and counting) and an IPO on the New York Stock Exchange.