In my last post, we looked at profit or loss as a key driver of cash flow. And we looked at specific tips for improving your profit.

In this post, I’ll show you how to write the one line explanation in your Cash Flow Focus Report, and determine whether the change is good or bad, when one of the three largest changes is accounts receivable.

If you sell products or services on terms where customers do not have to pay you at the time you make the sale, you will have accounts receivable on your balance sheet. And you will find that accounts receivable show up frequently as one of the three largest drivers of cash for the month.

A positive number – A positive adjustment to cash related to accounts receivable means you collected more money from customers on your existing accounts receivable than you billed to customers during the month. (Your accounts receivable balance on your balance sheet went down for the month.) This is usually the result of lower sales for the month (less invoicing to customers), faster collection of amounts due from customers, or a combination. When writing the one line explanation, I look first to see if DSO (days sales outstanding) has come down during the month. When the number of days of sales are down it means you are collecting money faster than in prior months. That is almost always a good thing. Next, I look to see whether sales are down. Once I know that information, I can write the one line explanation.

A negative adjustment – A negative adjustment to cash related to accounts receivable means you sold more to customers on credit than you collected from customers during the month. (Your accounts receivable balance on your balance sheet went up for the month. Your customers owe you more money now than when the month started.) This is usually the result of higher sales for the month (more invoicing to customers), slower collection of amounts due from customers, or a combination. When the accounts receivable adjustment is a negative number I look to see if DSO (days sales outstanding) has gone up during the month. When the number of days of sales are up it means collections have slowed down during the month. That is almost always a bad thing. Next, I look to see whether sales are up and the extent to which that is driving the adjustment. Once I know that information, I can write the one line explanation.

Labeling the Change as Good or Bad – Deciding whether the change, positive or negative, is good or bad requires that you look at what caused the change and how that compares to your expectation or plan. For example, if your change is a positive $100 thousand and the change was driven by lower sales for the month, you would need to compare that to your expectations for the month. If that month is a seasonally weak month and you fully expected sales to be down, and you are otherwise on plan for your profit and collection targets, the change would be labeled as good. It was not a surprise because sales in that month of the year are always down and it was consistent with your plan or budget.

On the other hand, if the positive $100 thousand change was driven by lower sales for the month because you lost your largest customer, that would be bad. The sales reduction would be an unpleasant surprise and it is a sign of a problem that you need to address in the business.

Let’s look at an example from Lisa’s business for the same month we looked at in my last post about profit as a key driver of cash flow.

In that month, profit was one of the three largest drivers of cash for the month. Profit was $32 thousand. Her one line explanation of the change said: “Sales were up nicely, a number of large orders had shipped.” It was a nice profit for the month driven by an increase in sales from the large orders that shipped during the month.

Accounts receivable was also one of her three largest drivers of cash for the month. The change in accounts receivable was ($46) thousand. When accounts receivable is a negative number in your focus report (a negative adjustment to cash), that means you sold more to customers on credit than you collected from customers in cash during the month. Her one line explanation said: “The large orders shipped were on credit.”

The large orders that shipped last month that helped create a nice profit were to customers on credit. They have 30-day terms and had not been paid at the end of the month. They were shipped mid-month, so they were not even due until the following month. If your sales vary in a meaningful way from month to month, you will likely see accounts receivable show up frequently as one of the three largest drivers.

Lisa labeled the accounts receivable driver as “Good” even though it was a negative adjustment to cash. The change made perfect sense and she fully expects those customers to pay on time in the following month.

Four Steps for Managing Accounts Receivable Wisely

Making the sale to a customer is important. But collecting the money from that sale is even more important. It does not do any good to sell a product or service to a customer if you don’t collect the money, if you don’t turn that sale, that accounts receivable, into cash in your bank account. In fact, you can ruin a business real fast if you neglect the all-important step of making sure you turn your receivables into cash as quickly as possible.

Receivables are viewed as nothing more than test market expenses until they are paid. There is no sale assumed, no customer satisfaction believed, and no commission paid until the money arrives.”

The Six-Month Fix, by Gary Sutton

I had the President of a national association of small business owners tell me a story about one of their members that highlights this point. One of their members started a service business catering to large health care organizations. She would provide trained staff to perform services that the organizations would otherwise have to hire employees to perform. She provided a turnkey service that would help improve the service levels while at the same time save them money. After she got her first contract, she began the process of recruiting, interviewing, hiring, and training the new hires. This took about three months to complete.

After her team was in place and trained, they began providing the service. She sent her invoice to the organization after the first month of services had been provided. After a couple months went by, she got a really big surprise. It turns out they routinely held invoices from suppliers for at least 120 days before they paid them. In fact, it was an industry practice. She was now almost seven months into her new business, and she had not even collected the first dollar of revenue. She had been spending money all this time not realizing there would be this huge delay in collecting her money.

Unfortunately, she ran out of cash. When she started the business, she thought she would be able to get everything going much faster and she thought she would be able to do it a lot cheaper. But the really big surprise came when she realized the hard way that creating a sale and collecting the cash seldom happens at the same time.

There is a need for speed when it comes to turning your accounts receivable into cash. It is much more important than many business owners realize. Unlike a nice bottle of red wine, receivables don’t get better with age! They are more like a dozen eggs in your refrigerator. If they sit around too long, they will go bad and rot… and ruin your appetite… and possibly make you sick. If you have ever had a big receivable go bad, you know exactly what I mean.

Here are four things you need to do to manage accounts receivable well.

- Invoice customers early and often.

- Be all over the accounts receivable aging report.

- Think and teach “expediting” rather than “collecting.”

- Measure and monitor DSO (days sales outstanding).

Invoice customers early and often. When you extend credit to customers, you are allowing them to buy your products and services and pay for them at a future date. It is not uncommon to provide 30-day terms. The customer has 30 days to pay for what they bought. The key is that the 30-day period starts from the invoice date. If you are slow in creating and sending the invoice to the customer then you are hurting your cash flow.

Here is an example. Assume a business provides 30-day terms to customers. They sell a product to the customer on May 10. The bookkeeper works part time. The bookkeeper does the customer invoicing at the end of the month so they can get all the invoicing done at one time. On May 31, the customer invoice is created and sent to the customer. If the customer pays on time, the money for the sale on May 10 would arrive around June 30. That’s 51 days from the sale to collecting the money for the sale. 21 days to get the invoice to the customer plus another 30 days for the customer to pay. The delay in sending the invoice almost doubled the amount of time you were without the cash from the sale.

Take a look at the invoicing process in your business. Is there any delay at all in creating and sending invoices to customers? If there is, I encourage you to consider ways to get invoicing done at the time of sale. “Batch processing” of customer invoices is not the way you want to do it.

Be all over the accounts receivable aging report. The AR aging report is a great tool for the person in your company responsible for turning accounts receivable into cash. It’s also a great management tool for you. It helps you manage your receivables and monitor how well your staff is performing their job.

Here’s a 5-step process for making effective use of the AR aging report.

- Have someone print the AR aging report and walk you through every account that is past due.

- Discuss the next steps they will be taking on every past due invoice.

- Have them document those next steps in a memo after your meeting.

- Schedule a follow up meeting to track their progress.

- Go back to step 1 (this is an ongoing management process).

Walking through each of the 5 steps will show you whether the person responsible for turning receivables into cash knows exactly what’s going on with every past due customer invoice.

A strategy that has worked wonderfully for me, especially with a company that has an accounts receivable problem, is to schedule a meeting like this every week and go through the five steps. Once the problem is under control, you can consider moving it to once a month. If you don’t have an accounts receivable problem, then I would suggest you do the meeting at least once a month. You will be surprised how effective those meetings can be in improving your cash flow.

Another tip for the meeting is that once you get into a good rhythm (once you have been doing the meetings regularly) consider having your staff prepare the recap memo from step 3 in advance of the meeting. By that time your staff already knows what will be discussed about each invoice or each customer account. So, documenting that in advance, together with setting out their next steps, is a great way to further streamline the meeting. And it puts more of the responsibility and accountability for managing the accounts receivable process on their shoulders.

Think and teach “expediting” rather than “collecting.” Most people think about collecting receivables as being a hard-nosed, demanding approach to making someone pay. It’s natural to think about the role of turning your receivables into cash as one of “collections”. You have to “collect” what you are owed. So, the person charged with the responsibility for collecting must be the “collector”. But that is only productive with certain types of receivables.

If you collect from individuals on credit card debts, student loans, or other consumer debt, then you are more likely to have to use the traditional “pay the bill or else” approach to collections. But if your receivables are with other businesses (especially if those businesses are much larger than you), you would be wise to modify your approach to getting paid. Sometimes the best way to improve a process… is to change how you think about that process all together.

A concept I have found very effective is to shift the focus from “collecting” to “expediting”. It’s a mindset shift that you have to teach to the person responsible turning your receivables into cash. At first it will sound to them like a small distinction… but it isn’t. It can be a real game changer.

We’re going to use Stephen Covey’s advice and “begin with the end in mind”. Our goal is to get paid. And since we are not going to be “collecting”, we have to shift our focus to “expediting” our invoice though the customer’s review process and ultimately to the point where we get paid. To accomplish that, we have to understand how an invoice flows through the customer’s process from beginning to end. We have to think like the customer.

We get to use more of Stephen Covey’s wisdom here because we need to “seek first to understand, then to be understood”. If our customer is a one person operation, then it’s easy. We need to find out exactly how and where he or she wants the invoice delivered. And we know exactly who to call to find out the status of the payment.

If our customer is a Fortune 100 company, then it is a bit more complicated. The people placing orders are probably scattered across the country… there may be multiple approvals required… and the accounts payable department may be in a different part of the country than the person or division that ordered from us. They likely have a workflow software system with very specific criteria for how the invoice will move through the process and ultimately get paid.

Here’s the cool part. We can learn how our customer’s payment processing system works while at the same time making the customer feel good about us and speeding up their payments to us. Let’s look at an example so you can see how it all works together so nicely. My focus on changing the mindset from collecting to expediting came when a company I worked with was struggling to get paid by some of its larger customers. About 30% of revenues were to a relatively small number of reputable, large companies. My client was relatively small at about $10 million in annual revenues. The large customers were billion dollar companies. Those customers were very important AND hard to collect from.

Cash was tight so keeping the DSO in line was critical. I interviewed the staff and quickly got a sense for how they were trying to collect those invoices – and why a shift in mindset and approach was needed. Here’s an example of how we did it with one large customer in particular. The customer (I’ll call them Big Fish) was greater than 10% of revenues and VERY slow to pay. And getting slower. The owner was struggling to find a way to fix the problem but it only seemed to be getting worse as each month went by.

Big Fish had a number of divisions making purchases. Each one was invoiced in a different way and the invoice was sent to different places. We kicked off the new “expediting” approach with a call to several of the buyers and key contacts at Big Fish. We started the call by saying we had a feeling we were not doing a good job in the way we invoiced the various divisions because their receivables had begun to age and payments appeared to be slowing down. As a result, we had been making more calls to their accounting department and more calls to them to help us track down payments on forty or more invoices.

We basically set the stage that we considered the problem to be on our end and that we wanted to help them by finding out what we could do better in the invoicing process so we did not add to their workload. Our first step was to learn THEIR process for receiving, approving, and paying invoices.

We learned in the first few minutes of the call that there were two divisions where we were sending invoices to the wrong person. And that they would be processed faster if we sent them by email rather than by mail (which we previously thought was how they required them to be sent). They also introduced us to the person in the Accounts Payable department we could contact anytime that we wanted to see how various invoices were progressing through their system. She had access to the workflow system and could quickly see if there was a problem with an invoice.

The cool thing about this approach is the customer appreciated our care and concern. They appreciated the fact that we wanted to make things easier on their end. And because they were not out to create problems with our accounts receivable, they put a renewed focus on helping us solve the problem. It wouldn’t have happened that way if we tried the traditional approach of just beating on them to pay in accordance with our terms. They were a huge company and we were small. Trying to flex our muscles was not the ticket to getting paid in that situation.

Here are some of the benefits of the shift to “expediting” accounts receivable:

- It’s easier (and feels better) for the people calling customers to get payment.

- It feels better to customers too (irritating a customer is a big risk when “collecting”).

- It will help you drive DSO down (more about DSO in just a minute). The result is more cash in the bank (and fewer bad debts).

- It will free up your time because you won’t have to constantly ride your team to speed up the payment process.

- You will build a stronger and deeper relationship with your customer.

Remember, you have to teach your staff how to do this properly. And once you do, you will find it much easier to get paid from those customers who are much bigger than you are. And you will be making your relationship with that customer stronger in the process. That’s a nice win-win.

Another tip to mention is that in many businesses the person charged with collecting is in accounting. And it’s usually not their primary focus. It is something that has been added to their responsibilities, usually when cash gets tight and you put some heat on them. Here’s a little insight though about most bookkeepers and accountants – they usually hate to collect receivables. As a result, they are not always good at it. (Nothing against accountants – since I’m one myself. Just a statement of fact that is important to remember.) You want to make sure that the person responsible for turning your receivables into cash is well suited for that work.

Measure and monitor DSO (days sales outstanding). My favorite big picture metric for monitoring accounts receivable is DSO. DSO stands for days sales outstanding. It is the number of days of sales that are sitting in, sometimes stuck in, accounts receivable. I monitor DSO monthly (sometimes weekly) to see how the metric is trending. I am especially looking for any increase in the DSO that would suggest collections on receivables are slowing.

Here is an example of how a business owner and I used DSO to improve cash flow at his software company. Hal is the owner of a successful company that was growing nicely. Almost a year ago, he was having a cash problem. Sales were doing well. The income statement was showing a profit every month. But cash was tight… and getting tighter. Hal and his Controller spent some time with their accounts receivable aging report, and it became clear that there had been a slow-down in collecting receivables. He asked the Controller to start calling customers to find out what the problem was and to begin actively working the past due receivables. The Controller got on it in mid-January and made good progress collecting many of the past due balances over the following three months.

Now in October of this year, cash was getting tight again. Hal didn’t think the problem was accounts receivable because they had addressed that issue earlier in the year. And sales and profit were on plan. He wasn’t sure the cause, he just knew he had a cash problem that needed attention. So, he asked me to help him figure out the problem.

My first step was to shine a light on DSO. Hal had updated me on the work his Controller had done last year to collect receivables faster. I was curious to see what DSO looked like by month over the last fifteen months. I wanted to see if the big picture view of the numbers, DSO in particular, supported his conclusion about accounts receivable being in good shape.

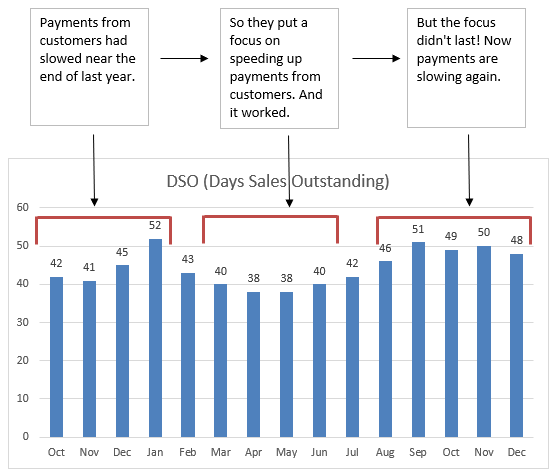

Here’s a graph of DSO by month from October of the prior year to December of the current year.

On the left side of the chart, you can see the problem they were feeling back in October through December of the prior year. DSO was rising. That means payments from customers on amounts they owed to the company were slowing down. Hal was feeling that slowdown in the form of cash balances that were uncomfortably low.

In mid-January of the current year is when the Controller began actively monitoring the accounts receivable aging report and calling customers that were past due. They saw improvement beginning in February as older receivables were being paid. DSO came down nicely from 52 to 38 over a three-month period. That 14-day DSO reduction brought the normal receivables balance of $427 thousand down to $312 thousand. The improvement added $115 thousand to their cash balance. That was a nice addition to their cash balance.

What Hal did not realize was once the cash started flowing in and the past due receivables were cleared up, they let up on the daily practice of actively working their accounts receivable aging. And as their attention was directed at other projects within the company, collections suffered. DSO started going back up in July just like it had done near the end of last year. You can see the increase on the right side of the DSO graph.

Once I showed Hal the graph, he put two new practices in place within the company. First, he had the Controller make the practice of actively monitoring and managing the accounts receivable aging report a permanent practice. Second, he added DSO to his list of weekly metrics that he monitored closely. The set a target for what DSO should be and he made sure the Controller, and everyone else on the team, knew what their goals and objectives were. Surprise, surprise! The DSO number stayed down after that.

I have seen many examples like this in my career where a consistent focus on DSO by the owner helps drive accounts receivable down and frees up much needed cash for the business.

Speaking of setting goals and targets for DSO, here is a visual I love.

I’m a big fan of using interactive reports and dashboards in Power BI to manage and monitor the metrics that matter in a business. And DSO is a metric that matters to cash flow. I use a dashboard type display to visually communicate how the company is doing on DSO.

It is crystal clear to the business owner whether DSO is looking good (in the green), drifting away from the target (in the yellow), or a problem (in the red). It forces you to define what good, not so good, and bad look like in terms of DSO in any given week or month. It is a fantastic way to monitor the speed that you are turning receivables into cash in your company.

Another way to use DSO is to compare your DSO to companies similar to you. If your DSO was 25 days (meaning there are approximately 25 days of sales that have not yet been converted into cash) but industry practice or your competition is more like 15 days, then you have a problem. There is probably something wrong with your process or your execution if you are out of whack with norms in your industry. It’s also possible you are using payment terms as a competitive weapon – which can be a very risky strategy.

Summary

Ideally, you want to be paid at the time you sell to customers. Or even get paid in advance. But that is not always possible. In which case, you must be focused on invoicing customers early and often… then be all over getting those invoices collected on or before the due date.

You can ruin a business real fast if neglect the all-important step of making sure you are collecting the money for what you sell.

Remember, there is a need for speed when it comes to turning your receivables into cash in the bank.

Understanding the Drivers of Cash Flow – Inventory

In my next post in this series, I’ll talk about how to write the one line explanation in your Cash Flow Focus Report, and determine whether the change is good or bad, when one of the three largest changes is inventory.

If you sell products to customers, then you likely have inventory on your balance sheet. You buy inventory, pay for it, then ultimately sell it to customers. The fact that you buy the inventory weeks or months before you sell it to a customer (and possibly wait even longer before that sale becomes cash), creates a big drain on cash.

Inventory will show up frequently as one of the three largest drivers of cash in a month. I will show you how to write your one line explanation in the Cash Flow Focus Report and understand what it means when the change is a positive or negative number.

I will also share some tips and strategies for managing your inventory more effectively.

Summary and Links to Other Posts in This Series

Here is a short recap and a link to each blog post in this series on making your cash flow simple and easy-to-understand.

Part 1 – The surprising results of my super-short survey that asked: “How do YOU define cash flow in your business”?

Part 2 – “Cash flow” is not a single number on your financial statements. Now is the time to totally rethink (and greatly simplify) how you go about understanding and managing cash flow in your business.

Part 3 – I use a VERY different, simple approach to defining cash flow. It is an approach where I take my CPA and CFO hat off and speak in a common-sense language that you can relate to.

Part 4 – The Cash Flow Focus Report is a simple, common sense tool for understanding your cash flow that takes 10 minutes a month. It brings focus to your cash flow, simplifies your life, and leads to an understanding and sense of confidence that you will find freeing.

Part 5 – The four reasons cash flow has always been so confusing and complicated for business owners (and for bookkeepers and accountants too).

Part 6 – I show you the 4-step process for completing the Cash Flow Focus Report. I walk through each step in the process using a real-life small business example. It’s a cool little company that was founded almost 20 years ago. It has grown nicely over the years and the owners love the business. Last month, the business showed a profit of $32 thousand. But their cash balance went down during the month by $6 thousand (from $116 thousand down to $110 thousand). The Cash Flow Focus Report shows what caused the change in cash.

Understanding the Drivers of Cash Flow – There are a number of different drivers of cash (in addition to profit or loss) that you will encounter as you complete the Cash Flow Focus Report each month. You will not run into all of them in one month because we are only focusing on the three largest changes, or drivers, of cash for each month. But as each month goes by, you will eventually see each one of these drivers impact your cash.

Understanding the Drivers of Cash Flow – Profit or Loss – Over time, profitability is a super important driver of your cash flow. You want to see profit show up in the list of your three largest drivers of cash regularly. While it is not unusual to have a month where profit does not make the list of top three drivers, profit needs to be there often, or you likely have a problem that needs attention.

Philip Campbell is an experienced financial consultant and author of the book A Quick Start Guide to Financial Forecasting: Discover the Secret to Driving Growth, Profitability, and Cash Flow and the book Never Run Out of Cash: The 10 Cash Flow Rules You Can’t Afford to Ignore. He is also the author of a number of online courses including Understanding Your Cash Flow – In Less Than 10 Minutes. His books, articles, blog and online courses provide an easy-to-understand, step-by-step guide for entrepreneurs and business owners who want to create financial health, wealth, and freedom in business.

Philip’s 35 year career includes the acquisition or sale of 35 companies (and counting) and an IPO on the New York Stock Exchange.

Understanding Your Cash Flow – In Less Than 10 Minutes

This online course teaches you the step-by-step process for simplifying your cash flow. I walk you through each lesson while you watch, listen, read and try it yourself using your own cash flow numbers.

The course is very affordable. And there are also some coaching options available if you would like to get up and running fast.

It’s a fantastic way to learn the process.

I take all the risk out of your purchase because I include a 100%, no questions asked, money-back guarantee. You love it or you get your money back in full. Period.

There are two things that are very unique and exciting about this online course.

1. I’ll show you how to understand your cash flow in less than 10 minutes

2. I’ll show you how to explain what happened to your cash last month to your business partner or banker (or maybe even your spouse) in a 2-minute conversation.

I take off my CPA hat and I speak in the language every business owner can relate to. No jargon. No stuffy financial rambling. Just a simple, common sense approach that only takes 10 minutes a month.

Here is how one business owner describes the benefits of the course.

“I googled cash flow projections and found your website online and it appealed to me mainly due to the fact that you speak in laymen’s terms in a way that a non-financially trained person can understand.

The fact that you said you can understand your cash flow in less than 10 minutes a month was also a big reason I bought it. And the fact that you acknowledge that most accountants and CPA’s speak in terms that the normal owner cannot understand and that you would be able to put things in understandable terms really got me.

The monthly cash flow focus report was the best feature for me because learning to do it helped me understand my cash flow statements and the biggest drivers of cash flow.

Another significant benefit is the definitions of cash flow drivers and descriptions of how a negative or positive sway in cash within those drivers affects cash flow. Being able to see at a quick glance monthly what happened to your cash using the focus report is a huge benefit.”